Video Displays, Inc. (VDI) is a privately held corporation chartered under the Canada Business Corporations Act. The

Question:

Video Displays, Inc. (VDI) is a privately held corporation chartered under the Canada Business Corporations Act. The corporation was formed in 20X1 by four engineers who found them-selves jobless after their previous employer (Argo Corporation) discontinued the production of television sets in Canada.

One of the sidelines of Argo had been the assembly of video display units (VDUs). A VDU is the basic chassis containing the liquid crystal display (LCD) screen and related components that are used in computers and in video game sets. When Argo discontinued production, the four engineers purchased some of Argo’s assembly and testing equipment and formed VDI.

VDI has been fairly successful because it is the only Canadian producer of VDUs. Some computer manufacturers have a policy of obtaining their components in the country in which they manufacture the computers and thus VDI has enjoyed the benefits of local- sourcing policies since it is the only Canadian producer.

In 20X4, VDI needed additional debt financing. After being refused by several Canadian banks, the executives of VDI went to New York where, on March 1, they quickly obtained a five- year, 12% term loan of $ 3,000,000 (US) from Citibank, with interest payable annually on the anniversary date of the loan. The US dollar was worth C$ 1.10 on March 1, 20X4. By the end of 20X4, the exchange rate had slipped to $ 1.06.

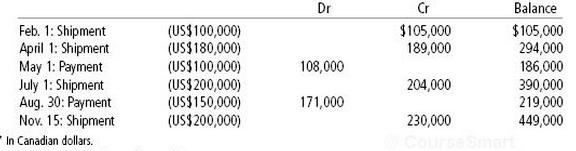

In 20X5, VDI extended its operations into the United States by contracting with an electronic component distributor in Cambridge, Massachusetts. The US distributor supplies component assemblies to small manufacturers, and saw an opportunity to sell VDI’s VDUs to independent manufacturers of computers. The December 31, 20X5, VDI unadjusted trial balance showed a balance due from the US distributor of $ 449,000. The 20X5 shipments to and payments from the distributor are shown in Exhibit A. VDI gave the distributor US$ 60,000 on April 4 as an accountable advance for financing promotional expenses. By December 31, 20X5, the distributor had spent and accounted for $ 40,000 of this advance. At the end of 20X5, the exchange rate was C$ 1.15 to US$ 1.00.

Required

Explain the impact of the transactions described above on VDI’s financial statements on December 31, 20X5.

Exhibit A Current Account with US Distributor 20X5*

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay