Vincent is a 50% partner in the TAV Partnership. He became a partner three years ago when

Question:

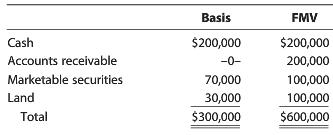

Vincent is a 50% partner in the TAV Partnership. He became a partner three years ago when he contributed land with a value of $60,000 and a basis of $30,000 (current value is $100,000). Tyler and Anita each contributed $30,000 cash for a 25% interest. Vincent’s basis in his partnership interest is currently $150,000; the other partners’ bases are each $75,000. The partnership has the following assets:

In general terms, describe the tax result if TAV distributes a $50,000 interest in the land each to Tyler and Anita and $100,000 of accounts receivable to Vincent at the end of the current year. Calculations are not required.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney