Westfield Capital Management Co.s equity investment strategy is to invest in companies with low price-to-book ratios, while

Question:

Westfield Capital Management Co.’s equity investment strategy is to invest in companies with low price-to-book ratios, while considering differences in solvency and asset utilization. Westfield is considering investing in the shares of either Jerry’s Departmental Stores (JDS) or Miller Stores (MLS). Selected financial data for both companies follow:

-1.png)

Required:

a. Compute each of the following ratios for both JDS and MLS:

(1) Price-to-book ratio

(2) Total-debt-to-equity ratio

(3) Fixed-asset-utilization (turnover)

b. Select the company that better meets Westfield’s criteria.

c. The following information is from these companies’ notes as of March 31, 2006:

(1) JDS conducts a majority of its operations from leased premises. Future minimum lease payments (MLP) on noncancellable operating leases follow ($ millions):

MLP

2007. . . . . . . . . . . . $ 259

2008. . . . . . . . . . . . . 213

2009. . . . . . . . . . . . . 183

2010. . . . . . . . . . . . . 160

2011. . . . . . . . . . . . . 155

2012 and later . . . . . 706

Total MLP. . . . . . $1,676

Less interest. . . . . (676)

Present value of MLP. . . $1,000

Interest rate. . . . . . . . . . 10%

(2) MLS owns all of its property and stores.

(3) During the fiscal year ended March 31, 2006, JDS sold $800 million of its accounts receivable with recourse, all of which was outstanding at year-end.

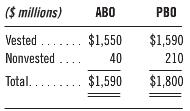

(4) Substantially all of JDS’s employees are enrolled in company-sponsored defined contribution plans. MLS Sponsors a defined benefits plan for its employees. The MLS pension plan assets’ fair value is $3,400 million. No pension cost is accrued on its balance sheet as of March 31, 2006 (note that MLS accounts for its pension plans under SFAS 87). The details of MLS’s pension obligations follow:

Compute all three ratios in part (a) after making necessary adjustments using the note information. Again, select the company that better meets Westfield’s criteria. Comment on your decision in part (b) relative to the analysis here.

SolvencySolvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Statement Analysis

ISBN: 978-0078110962

11th edition

Authors: K. R. Subramanyam, John Wild