When you go on the Web to find a firms beta, you do not know how recently

Question:

When you go on the Web to find a firm’s beta, you do not know how recently it was computed, what index was used as a proxy for the market portfolio, or which time series of returns the calculations used. Earlier in this chapter, it was shown that when we went on the Web to find a beta for AT&T, we found the following: MSN Money (0.53), Yahoo! Finance (0.38), and Zacks (0.54).

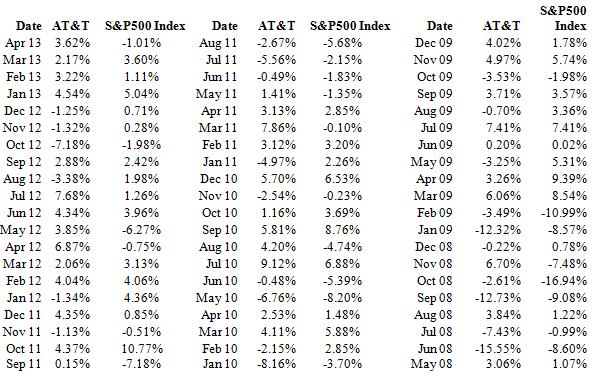

An alternative is to compute beta yourself. A common estimation procedure is to use 60 months of return data and to use the S&P 500 Index as the market portfolio. You can obtain price data for a company and for the S&P 500 Index for free from websites like Yahoo! Finance. Using monthly prices, you can compute the monthly returns, as (Pn − Pn-1) / Pn-1. Following are 60 monthly returns for AT&T and the S&P 500 Index. You can use these returns to compute AT&T’s beta. A spreadsheet, like Excel, can run a regression (go to Tool menu, select Data Analysis, and then Regression). Select AT&T returns as the y variable and S&P 500 Index return as the x variable. The coefficient for the x variable is the beta estimate. The regression will provide all the statistical information you might like. However, if you only want beta, you can simply use the SLOPE function in Excel. Or, you may have learned to run a regression using statistical software.

a. Compute AT&T’s beta using the returns listed.

b. Compare your estimate with the ones found on the Web as listed.

c. How different are the required returns using these betas? Compute required return using each beta (assume that the risk-free rate is 5 percent and the market return will be 13 percent).

Step by Step Answer:

Finance Applications and Theory

ISBN: 978-0077861681

3rd edition

Authors: Marcia Cornett, Troy Adair