Wilderness Products, Inc., has designed a self-inflating sleeping pad for use by backpackers and campers. The following

Question:

Wilderness Products, Inc., has designed a self-inflating sleeping pad for use by backpackers and campers. The following information is available about the new product:

a. An investment of $1,350,000 will be necessary to carry inventories and accounts receivable and to purchase some new equipment needed in the manufacturing process. The company’s required rate of return is 24% on all investments.

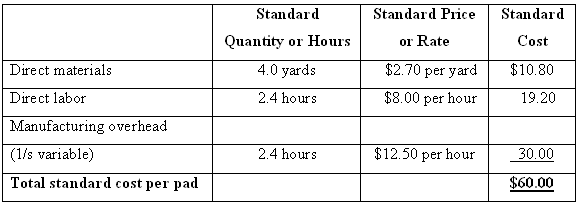

b. A standard cost card has been prepared for the sleeping pad, as shown below:

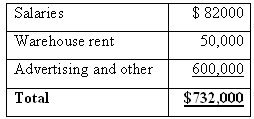

c. The only variable selling and administrative expense will be a sales commission of $9 per pad. Fixed selling and administrative expenses will be (per year):

d. Because the company manufactures many products, no more than 38,400 direct labor-hours per year can be devoted to production of the new sleeping pads.

e. Manufacturing overhead costs are allocated to products on the basis of direct labor-hours.

1. Assume that the company uses the absorption approach to cost-plus pricing.

a. Compute the markup that the company needs on the pads to achieve a 24% return on investment (ROI) if it sells all of the pads it can produce.

b. Using the markup you have computed, prepare a price quotation sheet for a single sleeping pad.

c. Assume that the company is able to sell all of the pads that it can produce. Prepare an income statement for the first year of activity and compute the company’s ROI for the ear on the pads.

2. After marketing the sleeping pads for several years, the company is experiencing a falloff in demand due to an economic recession. A large retail outlet will make a bulk purchase of pads if its label is sewn in and if an acceptable price can he worked out. What is the minimum acceptable price for this special order?

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer