Yarm Ltd. (Yarm) recently released its December 31, 2017 financial statements. In a press release announcing the

Question:

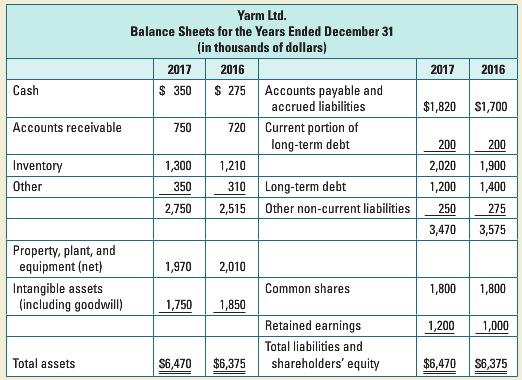

Yarm Ltd. (Yarm) recently released its December 31, 2017 financial statements. In a press release announcing the results, Yarm's management proudly stated that the company had maintained its debt load well below the industry average of 2.5 to 1. Yarm's summarized balance sheet for the years ended December 31, 2016 and 2017, along with extracts from the notes to the financial statements, are provided below.

Required:

Assess Yarm's debt position. Do you think management should be as proud of its financial situation as it is? Explain your thinking. (For discounting, an appropriate rate is 10 percent.)

Extracts from Yarm's financial statements:

• The company leases most of its production equipment. The leases are generally for four to five years and all are classified as operating leases. Minimum annual lease payments for the next five years are:

2018………………………….. $750,000

2019………………………….. $775,000

2020………………………….. $810,000

2021………………………….. $850,000

2022………………………….. $800,000

• The company has long-term binding commitments to purchase supplies from a Korean company. The commitments require a minimum purchase of $500,000 for the next three years.

• On January 15, 2018, the company signed an agreement to borrow $750,000 from a local bank. The annual interest rate on the loan will be 6 percent for a term of three years. The loan comes into effect on February 19, 2018.

Step by Step Answer: