You are considering investing in Eli Lilly, a major pharmaceutical company. As part of your investigation of

Question:

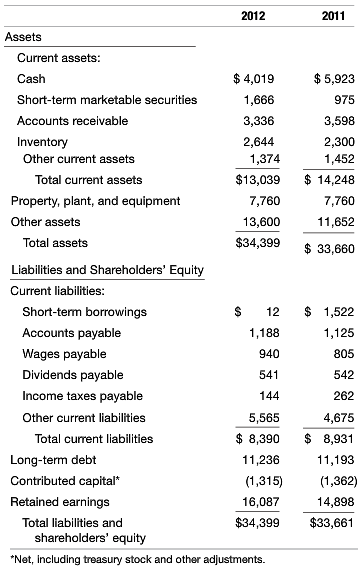

You are considering investing in Eli Lilly, a major pharmaceutical company. As part of your investigation of Lilly, you obtained the following balance sheets for the years ended December 31, 2012 and 2011 (dollars in millions):

REQUIRED:

a. Compute the dollar change in each account from 2011 to 2012. Also compute the percentage change in each account from 2011 to 2012.

b. Convert the balance sheets to common-size balance sheets. Also compute the percentage change in the common-size numbers of each account from 2011 to 2012.

c. Does the information in (b) provide any additional data to that in (a)? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: