Your client, Paul, owns a one-third interest as a managing (general) partner in the service-oriented PRE LLP.

Question:

Your client, Paul, owns a one-third interest as a managing (general) partner in the service-oriented PRE LLP. He would like to retire from the limited liability partnership at the end of 2016 and asks your help in structuring the buyout transaction.

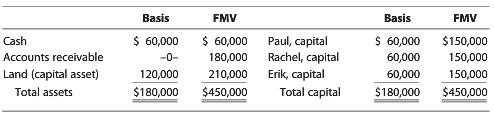

Based on interim financial data and revenue projections for the remainder of the year, the LLP's balance sheet is expected to approximate the following at the end of 2016:

Although the LLP has some cash, the amount is not adequate to purchase Paul's entire interest in the current year. The LLP has proposed to pay Paul, in liquidation of his interest, according to the following schedule:

December 31, 2016 ……………….. $50,000

December 31, 2017 ……………….. $50,000

December 31, 2018 ……………….. $50,000

Paul has agreed to this payment schedule, but the parties are not sure of the tax consequences of the buyout and have temporarily halted negotiations to consult with their tax advisers. Paul has retained you to ascertain the income tax ramifications of the buyout and to make sure he secures the most advantageous result available. Using the IRS Regulations governing partnerships, answer the following questions.

a. If the buyout agreement between Paul and PRE is silent as to the treatment of each payment, how will each payment be treated by Paul and the partnership?

b. As Paul's adviser, what payment schedule should Paul negotiate to minimize his current tax liability?

c. Regarding the LLP, what payment schedule would ensure that the remaining partners receive the earliest possible deductions?

d. What additional planning opportunity might be available to the partnership?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young