Alvamar Company has the following data for the weekly payroll ending January 31 Employees are paid 112

Question:

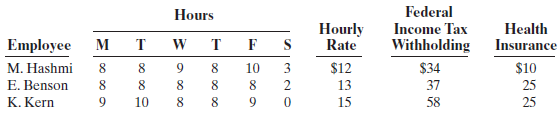

Alvamar Company has the following data for the weekly payroll ending January 31

Employees are paid 11⁄2 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 8% on the first $100,000 of gross earnings. Alvamar Company is subject to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross earnings.

Instructions

(a) Prepare the payroll register for the weekly payroll.

(b) Prepare the journal entries to record the payroll and Alvamar’s payroll tax expense.

Federal Income Tax Withholding Hours Health Insurance Hourly Rate Employee M. Hashmi E. Benson K. Kern M т т 3 8. 10 2 $34 37 $12 13 $10 25 8. 8. 8. 8. 15 9. 10 8. 9. 58 25 en 2 O

Step by Step Answer:

a ALVAMAR COMPANY Payroll Register For the Week Ending January 31 Earnings Deductions Employee Total ...View the full answer

Accounting Principles

ISBN: 9780471980193

8th Edition

Authors: Jerry J Weygandt, Donald E Kieso, Paul D Kimmel

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Accounting questions

-

Alvarez Company has the following data for the weekly payroll ending January 31. Employees are paid 1 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are...

-

Piniella Company has the following data for the weekly payroll ending January 31. Employees are paid 112 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes...

-

Welstead Company has the following data for the weekly payroll ending January 31. Employees are paid 112 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes...

-

A solid homogeneous disk 900 mm in diameter with a mass of 140 kg is rolled up 20 incline by a force of 1000 N, applied parallel to the plane. Assuming no slipping. determine the speed of the disk...

-

In the special report, "Bitter Pill: Why Medical Bills Are Killing Us" (TIME, Vol. 181, No. 8, 2013), S. Brill presented an in-depth investigation of hospital billing practices that reveals why U.S....

-

According to data from the Environmental Protection Agency, the average daily water consumption for a household of four people in the United States is approximately at least 243 gallons. Suppose a...

-

The market interest rate is 15 percent. What is the price of a consol bond that pays \($120\) annually?

-

Allison Corporation acquired 90 percent of Bretton on January 1, 2016. Of Bretton's total acquisition- date fair value, $60,000 was allocated to undervalued equipment (with a 10-year remaining life)...

-

Y7 . An investor has initial wealth w - 2, and a utility function U(w) = 1 - exp( -Aw). A lottery has a payoff of I with probability p and a payoff of -I with probability (1 - p). (a) Suppose A = 1...

-

Jorge is a registered nurse at a facility that cares for about 80 elderly patients. Jorge has been at the facility longer than any of the other nurses and has his choice of schedule; he believes he...

-

Employee earnings records for Medenciy Company reveal the following gross earnings for four employees through the pay period of December 15. C. Ogle .... $93,500 D. Delgado . $96,100 L. Jeter .......

-

Selected data from a February payroll register for Gerfield Company are presented below. Some amounts are intentionally omitted FICA taxes are 8%. State income taxes are 3% of gross...

-

In a town with exactly 1,000 residents,60 percent of the residents make healthy choices, and 40 percent of the residents consistently make unhealthy choices. The health insurance company in town...

-

In more recent times, one of the major challenges in staffing the front-desk is labor shortages or being short-staffed. It can be difficult to fill a shift or a front-office position when there are...

-

Carry trades in the foreign exchange markets are currently a widely used practice, not only by fund managers and traders, but also by individual investors. What is meant by carry trade in the foreign...

-

As an Fire Officer, unforeseen challenges are going to constitute the bulk of your workdays. It might be something big, like a long-committed employee who decided to quit, or something small, like a...

-

Explain Hester's concept of Fairness as a principle to guide urban design and reflect on how you think this characteristic is incorporated or not in the community Urban habitation where ecological...

-

Define challenges to innovation. Define barriers to innovation. Listed below are six different practices in organisations. Discuss how these practices can overcome challenges and barriers to...

-

A steel rod \(20 \mathrm{~mm}\) diameter is passed through a brass tube \(25 \mathrm{~mm}\) internal diameter and \(30 \mathrm{~mm}\) external diameter. The tube is \(1 \mathrm{~m}\) long and is...

-

A 20-cm-square vertical plate is heated to a temperature of 30oC and submerged in glycerin at 10oC. Calculate the heat lost from both sides of the plate.

-

Determine whether or not the region bounded by the curves is vertically simple and/or horizontally simple. y = x 2 , x = y 2

-

Why may a trial balance not contain up-to-date and complete financial information?

-

Depreciation is a valuation process that results in the reporting of the fair market value of the asset. Do you agree? Explain.

-

Explain the differences between depreciation expense and accumulated depreciation.

-

. Chapter 15 Homework 0 Saved Help Save& Exit Submit heck my work A For the yearjust completed, Hanna Company had net income of $35,000, Balances in the company's current asset and current lia...

-

What is the output?. Canvas O AF D Question 16 class SomeClass { public void print() { System. out. print( "A"); public class Main { public static void main(String args) { Some Class[ ] arra...

-

Boney Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $52 to buy from farmers and $11 to crush in the company's...

Study smarter with the SolutionInn App