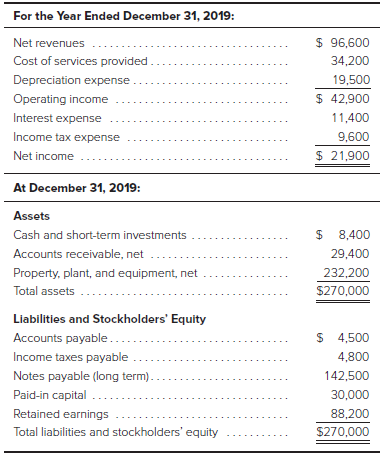

Gerrard Construction Co. is an excavation contractor. The following summarized data (in thousands) are taken from the

Question:

Gerrard Construction Co. is an excavation contractor. The following summarized data (in thousands) are taken from the December 31, 2019, financial statements:

At December 31, 2018, total assets were $246,000 and total stockholders? equity was $97,800. There were no changes in notes payable or paid-in capital during 2019.?

Required:a. The cost of services provided amount includes all operating expenses (selling, general, and administrative expenses) except depreciation expense. What do you suppose the primary reason was for management to separate depreciation from other operating expenses? From a conceptual point of view, should depreciation be considered a ?cost? of providing services?

b. Why do you suppose the amounts of depreciation expense and interest expense are so high for Gerrard Construction Co.? To which specific balance sheet accounts should a financial analyst relate these expenses?

c. Calculate the company?s average income tax rate. You must first determine the earnings before taxes.d. Explain why the amount of income tax expense is different from the amount of income taxes payable.

e. Calculate the amount of total current assets. Why do you suppose this amount is so low, relative to total assets?

f. Why doesn?t the company have a Merchandise Inventory account?

g. Calculate the amount of working capital and the current ratio at December 31, 2019. Assess the company?s overall liquidity.

h. Calculate ROI (including margin and turnover) and ROE for the year ended December 31, 2019. Assess the company?s overall profitability. What additional information would you like to have to increase the validity of this assessment?

i. Calculate the amount of dividends declared and paid during the year ended December 31, 2019. (Hint: Do a T-account analysis of retained earnings.)

1. It means that you are being asked to determine whether the account is for an asset, a liability, stockholders? equity element, revenue, or expense. Frequently, the account classification is included in the account title. In other cases, it is necessary to understand what transactions affect the account.

2. It means that the sum of the debit entries from transactions affecting the account, plus any beginning debit balance in the account, is larger than the sum of any credit entries from transactions affecting the account plus any beginning credit balance in the account.

3. It means that because the balance of these accounts is increased by a debit entry, an asset or expense account will usually have a debit balance.

4. It means that a transaction results in increasing the balance of these kinds of accounts.

5. It means that the sum of all accounts with debit balances in the ledger equals the sum of all accounts with credit balances in the ledger.

6. It means that revenue has been earned by selling a product or providing a service, or that an expense has been incurred, but that cash has not yet been received (from a revenue) or paid (for an expense) so an appropriate receivable or payable account, respectively, must be recognized.

7. It means that a more accurate income statement?matching of revenue and expense?and a more accurate balance sheet will result from the accrual or reclassification accomplished by the adjustment.

8. It means that the effect of the transaction on the affected accounts and financial statement categories is determined.

9. It means that by sketching a T and using arithmetic, if any three of the following are known?balance at the beginning of the period, total debits during the period, total credits during the period, or balance at the end of the period?the fourth can be calculated. The kinds of transactions or adjustments most likely to have affected the account are determined by knowing what the account is used for.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Accounting What the Numbers Mean

ISBN: 978-1260565492

12th edition

Authors: David Marshall, Wayne McManus, Daniel Viele