Owing to staff illnesses, the draft final accounts for the year ended 31 March 2012 of Messrs

Question:

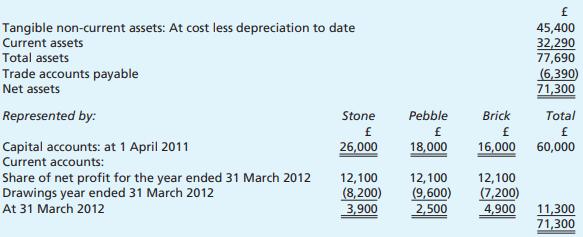

Owing to staff illnesses, the draft final accounts for the year ended 31 March 2012 of Messrs Stone, Pebble and Brick, trading in partnership as the Bigtime Building Supply Company, have been prepared by an inexperienced, but keen, clerk. The draft summarised statement of financial position as at 31 March 2012 is as follows:

The partnership commenced on 1 April 2011 when each of the partners introduced, as their partnership capital, the net tangible non-current and current assets of their previously separate businesses. However, it has now been discovered that, contrary to what was agreed, no adjustments were made in the partnership books for the goodwill of the partners’ former businesses now incorporated in the partnership. The agreed valuations of goodwill at 1 April 2011 are as follows:

It is agreed that a goodwill account should not be opened in the partnership’s books. It has now been discovered that effect has not been given in the accounts to the following provisions in the partnership agreement effective from 1 January 2012: 1 Stone’s capital to be reduced to £20,000, the balance being transferred to a loan account upon which interest at the rate of 11% per annum will be paid on 31 December each year. 2 Partners to be credited with interest on their capital account balances at the rate of 5% per annum. 3 Brick to be credited with a partner’s salary at the rate of £8,500 per annum. 4 The balance of the net profit or loss to be shared between Stone, Pebble and Brick in the ratio 5:3:2 respectively.

1 It can be assumed that the net profit indicated in the draft accounts accrued uniformly throughout the year. 2 It has been agreed between the partners that no adjustments should be made for any partnership goodwill as at 1 January 2012. Required:

(a) Prepare the profit and loss appropriation account for the year ended 31 March 2012.

(b) Prepare a corrected statement of the partners’ capital and current accounts for inclusion in the partnership statement of financial position as at 31 March 2012.

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan