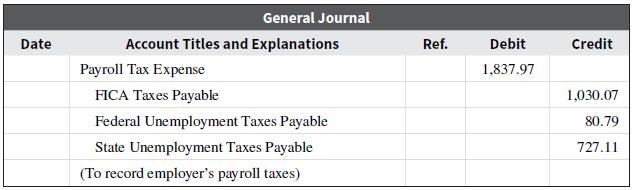

The following journal entry for payroll taxes has been recorded by Shania for her hair salon business.

Question:

The following journal entry for payroll taxes has been recorded by Shania for her hair salon business. Assume federal income tax is $3,190 and state income tax is $278. Prepare the journal entry to record payment of the payroll taxes, assuming all taxes were paid on the same day.

Transcribed Image Text:

General Journal Date Account Titles and Explanations Ref. Debit Credit Payroll Tax Expense 1,837.97 FICA Taxes Payable 1,030.07 Federal Unemployment Taxes Payable 80.79 State Unemployment Taxes Payable 727.11 (To record employer's payroll taxes)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 44% (18 reviews)

FICA Taxes Payable 103007 103007 206014 Federal Unemploy...View the full answer

Answered By

Saleem Abbas

Have worked in academic writing for an a years as my part-time job.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

College Accounting

ISBN: 1986

1st Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Deanna C. Martin, Jill E. Mitchell

Question Posted:

Students also viewed these Business questions

-

Romero Brothers Contracting reports a $ 1,200,000 bi- weekly payroll. Romero and its employees must pay Social Security ( FICA) taxes and none of the employees has exceeded the wage base. Income...

-

(Accounting PrinciplesComprehensive) Presented below are a number of business transactions that occurred during the current year for Fresh Horses, Inc. In each of the situations, discuss the...

-

The following journal entry summarizes for the current year the income tax expense of Wilsons Software Warehouse: Income Tax Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Question 7: The owner of a small social services management consulting firm wants to minimize the total number of hours it will take to complete four projects for a new client. Accordingly, she has...

-

A 236U nucleus undergoes fission and breaks into two middle- mass fragments, 140Xe and 96Sr. (a) By what percentage does the surface area of the fission products differ from that of the original 236U...

-

Prove that the graph of y 4x 2 + 2x + 5 = does not intersect the x-axis.

-

Situational and Contingency theory: A. Embodies the idea that the leader does the right thing based on the situation. B. Involves assessing the nature of the task and the followers motivation to...

-

Executives at Warner Brothers believe that Ellen DeGeneres is the heir apparent to Oprah Winfrey in daytime TV. In its last season, a research report revealed that The Ellen DeGeneres Show was, for...

-

McEwan Industries sells on terms of 3/10, net 20. Total sales for the year are $971,500; 40% of the customers pay on the 10th day and take discounts, while the other 60% pay, on average, 52 days...

-

Carol and Karl both solve difficult computer problems that come to the student desk. Carol makes 60% of the repairs and Karl 40%. However, Carol's repairs are incomplete 4% of the time and Karl's are...

-

Jose started a consulting firm last year and needs to hire one employee due to growth in the business. He is confused about all the tax forms he must complete once he starts paying payroll. For each...

-

Wages paid for the second quarter for Wang Law Firm were $56,792.00. All wages were subject to FICA taxes (the 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and...

-

Which journal columns are used to record paying cash on account?

-

Access the World Trade Statistical Review 2018 from the World Trade Organization. Scroll down to "Statistical Tables" to open the PDF file for the most recent trade statistics. Perform the following...

-

Asset (A) E(RA)=12% (A)=6% Asset (B) E(RB)=18% (GB) = 16% WA = 60% WB = 40% COVA,B = 0.00672 What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard...

-

Solve the equation 2x - 4 1 - 5 = = x-2' Does the equation have a solution? Input Yes or No here: If your answer is Yes, input your solution here: x =

-

USE THE IMRAD METHOD + ABSTRACT FOR THE WHOLE ARTICLE + PUT TITLE I - INTRODUCTION M - METHODOLOGY RaD - RESULT and DISCUSSION CONCLUSION INTRODUCTION SHOULD BE IN S.P.I.N. METHOD S - SITUATION P -...

-

Write a program that allows a user to enter a String. Each word in the String should be stored in a Queue. Once the user has entered the String and you have stored this in a Queue, use recursion to...

-

Consider a firm with a contract to sell an asset for $150,000 three years from now. The asset costs $102,000 to produce today. Given a relevant discount rate of 11 percent per year, will the firm...

-

The following selected accounts and normal balances existed at year-end. Notice that expenses exceed revenue in this period. Make the four journal entries required to close the books: Accounts...

-

A friend owns and operates her own business and is concerned about completing her tax return. She owns several assets and uses straight-line depreciation for business purposes. She intended to use...

-

Creative Solutions purchased a patent from Russell Lazarus, an inventor. At the time of the purchase, the patent had two years remaining. The president of Creative Solutions decided to have the...

-

On April 1, 20-3, Kwik Kopy Printing purchased a copy machine for $50,000. The estimated life of the machine is five years, and it has an estimated salvage value of $5,000. The machine was used until...

-

Carlos es un trabajador colombiano preocupado por su futuro financiero y su capacidad para pensionarse en el futuro. Conoce que la alta informalidad en la economa y posibles cambios en la edad de...

-

A bond has a coupon rate of 7%, and a yield to maturity of 9% will you be willing to pay $1100 for this bond. Explain.

-

I Of the domestic stock of 302 million hens, what percentage is conventional eggs? (1 point)

Study smarter with the SolutionInn App