As of mid-September 2013, you are valuing Honda Motor Company (TSE: 7267; NYSE ADR: HMC), among the

Question:

As of mid-September 2013, you are valuing Honda Motor Company (TSE: 7267;

NYSE ADR: HMC), among the market leaders in Japan’s auto manufacturing industry.

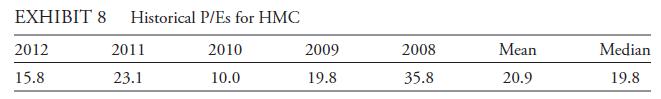

You are applying the method of comparables using HMC’s five-year average P/E as the benchmark value of the multiple. Exhibit 8 presents the data.

i. State a benchmark value for Honda’s P/E.

ii. Given EPS for fiscal year 2013 (ended 31 March) of ¥203.71, calculate and interpret a justified price for Honda.

iii. Compare the justified price with the stock’s recent price of ¥3,815.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: