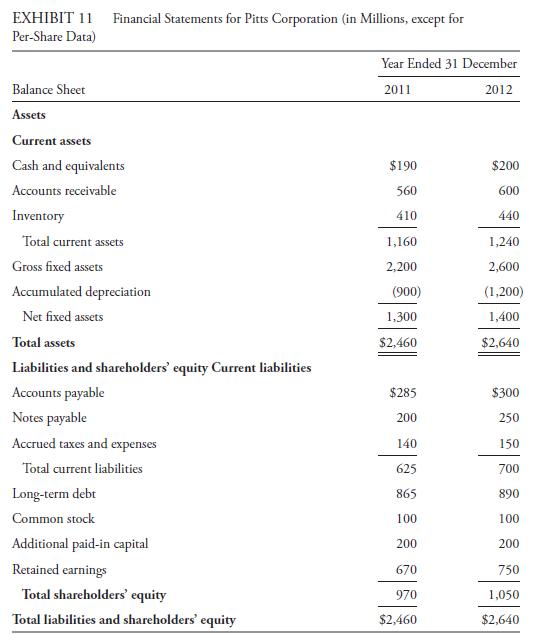

The balance sheet, income statement, and statement of cash flows for the Pitts Corporation are shown in

Question:

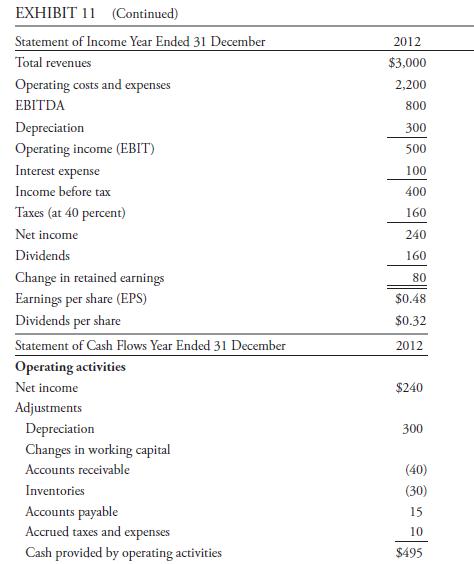

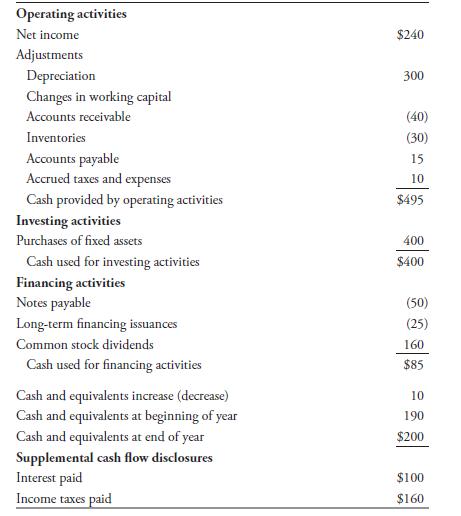

The balance sheet, income statement, and statement of cash flows for the Pitts Corporation are shown in Exhibit 11. Note that the statement of cash flows follows a convention according to which the positive numbers of \($400\) million and \($85\) million for “cash used for investing activities” and “cash used for financing activities,” respectively, indicate outflows and thus amounts to be subtracted. Analysts will also encounter a convention in which the value “(400)” for “cash provided by (used for) investing activities” would be used to indicate a subtraction of \($400\).

Note that the Pitts Corporation had net income of \($240\) million in 2012. In the following, show the calculations required to do each of the following:

i. Calculate FCFF starting with the net income figure.

ii. Calculate FCFE starting from the FCFF calculated in Part 1.

iii. Calculate FCFE starting with the net income figure.

iv. Calculate FCFF starting with CFO.

v. Calculate FCFE starting with CFO.

Step by Step Answer: