Vishal Noronha needs to prepare a valuation of Sindhuh Enterprises. Noronha has assembled the following information for

Question:

Vishal Noronha needs to prepare a valuation of Sindhuh Enterprises. Noronha has assembled the following information for his analysis. It is now the first day of 2013.

• EPS for 2012 is $2.40.

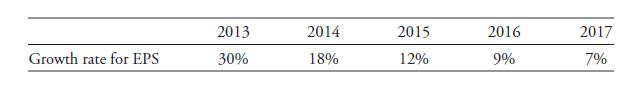

• For the next five years, the growth rate in EPS is given in the following table. After 2017, the growth rate will be 7 percent.

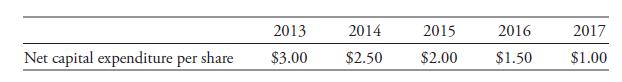

• Net investments in fixed capital (net of depreciation) for the next five years are given in the following table. After 2017, capital expenditures are expected to grow at 7 percent annually.

• The investment in working capital each year will equal 50 percent of the net investment in capital items.

• Thirty percent of the net investment in fixed capital and investment in working capital will be financed with new debt financing.

• Current market conditions dictate a risk-free rate of 6.0 percent, an equity risk premium of 4.0 percent, and a beta of 1.10 for Sindhuh Enterprises.

i. What is the per-share value of Sindhuh Enterprises on the first day of 2013?

ii. What should be the trailing P/E on the first day of 2013 and the first day of 2017?

Step by Step Answer: