Peter Liu has recently begun his accounting studies and is very confused about the concepts and principles

Question:

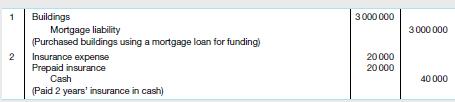

Peter Liu has recently begun his accounting studies and is very confused about the concepts and principles underlying the recording of accounting information. He has been asked prepare a class presentation on one of the homework questions on this topic. His tutorial is only 1 day away; he is very nervous and needs help. Given you have nearly finished your introductory accounting unit he has asked you for assistance. The question Peter needs to present is: For each of the following transactions, explain the main concept or principle that underlies its recording:

Include in your discussion any other relevant guidance that should be considered when recording these transactions.

Reasoning

To answer this question, you explain to Peter that he first needs to review each of the concepts and principles underlying the recording of accounting information. These include the monetary principle, accounting entity concept, accounting period concept, going concern principle, cost principle and full disclosure principle.

Then, once he has a good understanding of the concepts and principles, he will be able see which of these apply to the cases in the homework problem. It is important to notice that the question asks for the main concept or principle. Sometimes more than one can apply, so the main one must be chosen. For example, the monetary principle may apply in both cases as the transactions are recorded in dollars; however, the monetary principle may not be the main one, as explained below. Finally, while the focus of the question is on concepts and principles, as requested, it is important to explain to Peter that in practice the principles and concepts aren’t considered in isolation but work together with accounting standards and the Conceptual Framework which provide guidance for recording transactions, for example, the recognition criteria for assets, liabilities, revenues and expenses.

Step by Step Answer:

Financial Accounting Reporting, Analysis And Decision Making

ISBN: 9780730363279

6th Edition

Authors: Shirley Carlon