Question:

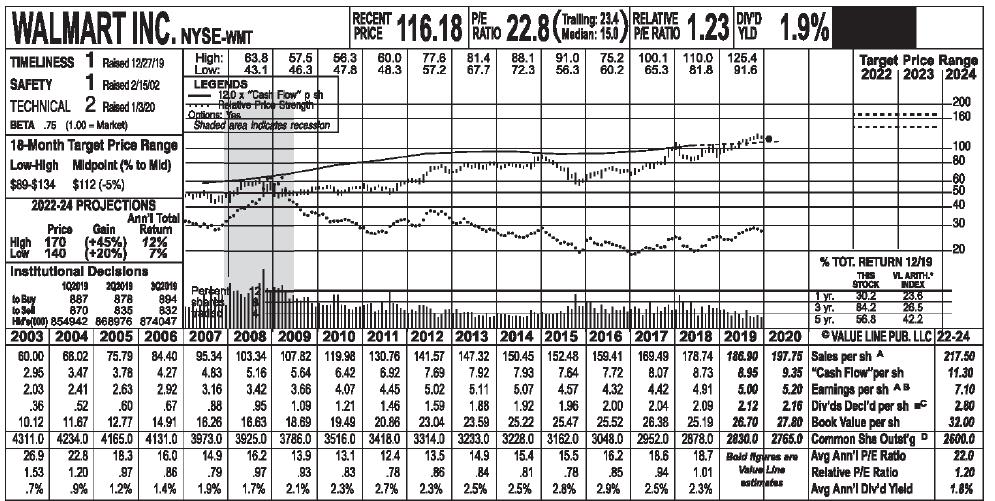

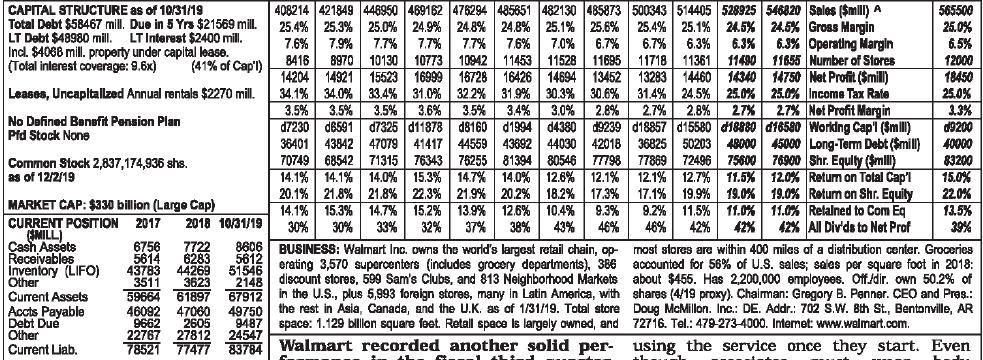

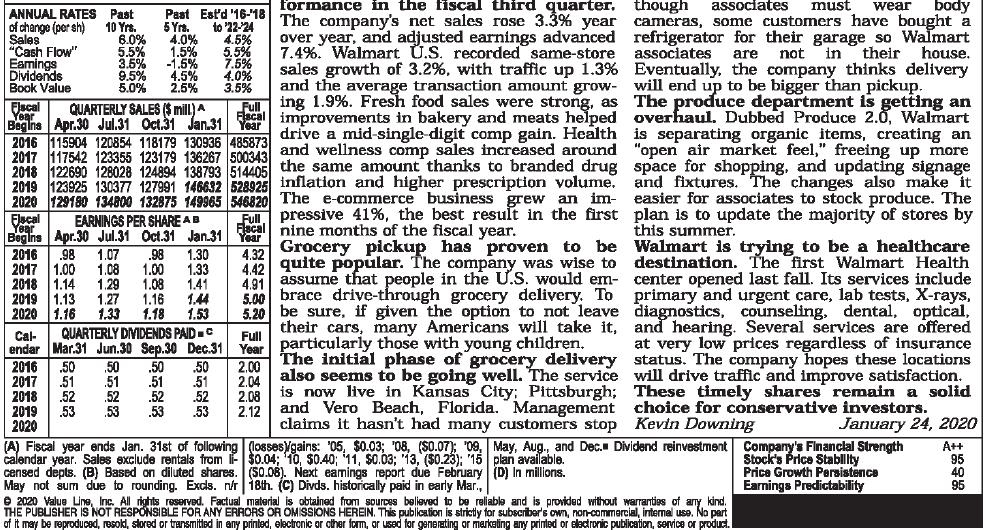

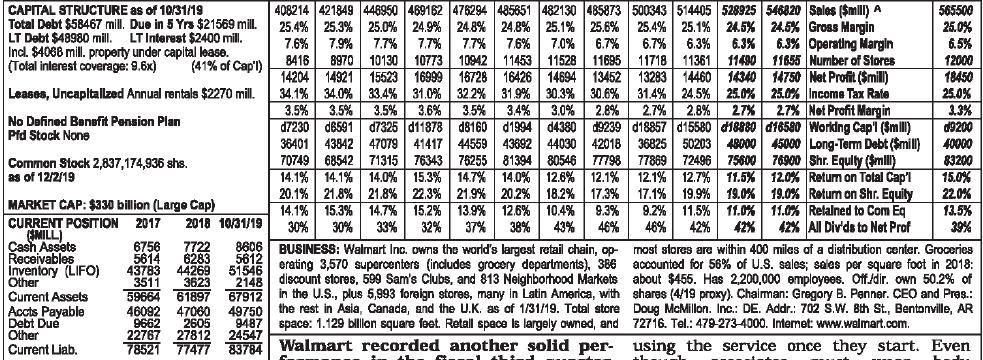

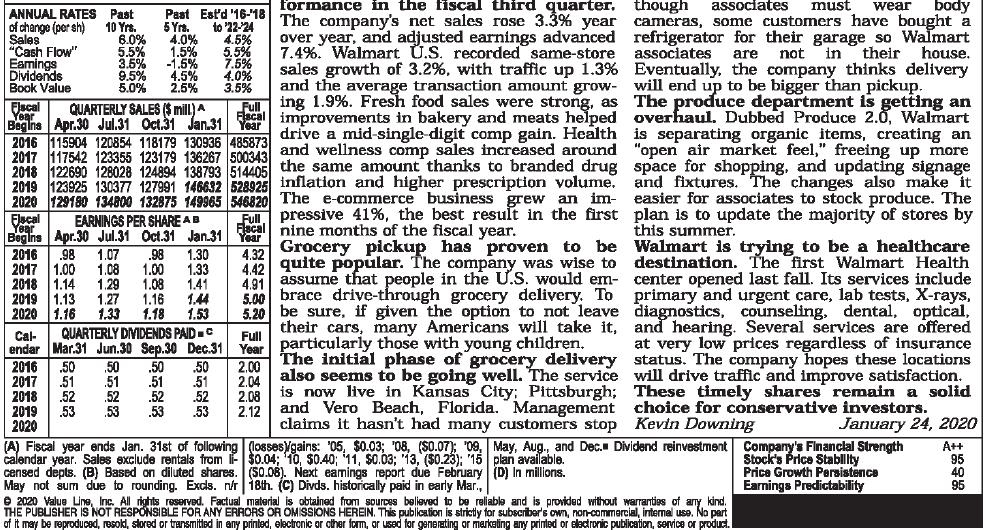

This chapter stressed the importance of evaluating potential investments. Now it’s your turn to try your skill at evaluating a potential investment in the Walmart Corporation. Assume you could invest $10,000 in the common stock of this company. To help you evaluate this potential investment, carefully examine Exhibit 14-7, which reproduces the research report on Walmart from Value Line.

The report was published on January 24, 2020.

Questions

1. Based on the research provided by Value Line, would you buy Walmart’s stock? Justify your answer.

2. What other investment information would you need to evaluate Walmart's common stock? Where would you obtain this information?

3. On January 24, 2020, Walmart’s common stock was selling for $116 a share. Using the internet, determine the current price for a share of Walmart’s common stock. Based on this information, would your investment have been profitable if you had purchased the common stock for $116 a share?

4. Assuming you purchased Walmart’s stock on January 24, 2020, and based on your answer to question 3, would you want to hold or sell your Walmart stock? Explain your answer.

Transcribed Image Text:

WALMART INC. NYSE-WHIT

TIMELINESS 1 Raised 12/27/19

SAFETY

1 Raised 2/15/02

TECHNICAL 2 Raised 1/3/20

BETA 75 (1.00- Market)

18-Month Target Price Range

Low-High Midpoint (% to Mid)

$89-$134 $112 (-5%)

2022-24 PROJECTIONS

Ann'l Total

Price

Gain Return

High 170 (+45%) 12%

Low 140

(+20%) 7%

Institutional Decisions

to Buy

to Sell

High: 63.8 57.5 56.3

43.1 46.3 47.8

Low:

LEGENDS

- 120 x "Cash Flow" p sh

Relative Price Strength

Options: Yes

Shaded area indicates recession

***

Perbent

sblattts.

RECENT

DIV'D

P/E

Tralling: 23.4 RELATIVE

PRET 116.18 RATIO 22.8 (3.0) PRATO 1.23 1.9%

**

..... --سالم

60.0 77.6 81.4 88.1 91.0 75.2 100.1

100.1 110.0 125.4

48.3 57.2 67.7 72.3 56.3 60.2 65.3 81.8 91.6

A

הה" יו

"Th

111.

1.

Target Price Range

2022 2023 2024

1 yr.

3 yr.

5 yr.

‒‒‒‒

-200

-160

% TOT. RETURN 12/19

THIS VL ARITH.*

STOCK INDEX

102019

202019 302019

30.2

23.6

887

894

878

835

84.2

26.5

870

832

H000) 854942 868976 874047AA

toldod

42.2

2010 2011 2012 2013 2014 2015 2016

217.50

11.30

5.20 Earnings per sh AB

7.10

56.8

2003 2004 2005 2006 2007 2008 2009

2017 2018 2019 2020 VALUE LINE PUB. LLC 22-24

60.00 68.02 75.79 84.40 95.34 103.34 107.82 119.98 130.76 141.57 147.32 150.45 152.48 159.41 169.49 178.74 186.90 197.75 Sales per sh A

2.95 3.47 3.78 4.27 4.83 5.16 5.64 6.42 6.92 7.69 7.92 7.93 7.64 7.72 8.07 8.73 8.95 9.35 "Cash Flow"par sh

2.03 2.41 2.63 2.92 3.16 3.42 3.66 4.07 4.45 5.02 5.11 5.07 4.57 4.32 4.42 4.91 5.00

.36 52 .60 .67 .88 .95 1.09 1.21 1.46 1.59 1.88 1.92 1.96 2.00 2.04 2.09 212

10.12 11.67 12.77 14.91 16.26 16.63 18.69 19.49 20.86 23.04 23.59 25.22 25.47 25.52 26.38 25.19 26.70

4311.0 4234.0 4165.0 4131.0 3973.0 3925.0 3786.0 3516.0 3418.0 3314.0 3233.0 3228.0 3162.0 3048.0 2952.0 2878.0 2830.0 2765.0

26.9 22.8 18.3 16.0 14.9 16.2 13.9 13.1 12.4 13.5 14.9 15.4 15.5 16.2 18.6 18.7 Bold figures are

1.53 1.20 97 .86 .79 .97 .93 .83 78 .86 84 81 .78 .85 .94 1.01

.7% .9% 1.2% 1.4% 1.9% 1.7% 2.1% 2.3% 2.7%

2.3% 2.5% 2.5% 2.8% 2.9% 2.5% 2.3%

2.80

32.00

2.16 Div'ds Decl'd per sh

27.80 Book Value per sh

Common She Outsi'g D

Avg Ann'l P/E Ratio

Relative P/E Ratio

2600.0

22.0

1.20

Value Line

estimates

Avg Ann'l Div'd Yield

-100

-80

-60

-50

-40

-30

-20

1.8%