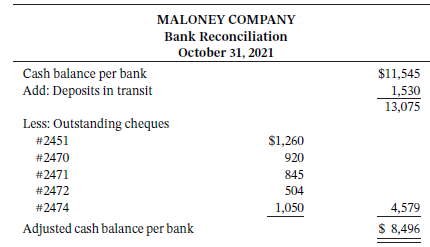

The bank portion of the bank reconciliation for Maloney Company at October 31, 2021, was as follows:

Question:

The bank portion of the bank reconciliation for Maloney Company at October 31, 2021, was as follows:

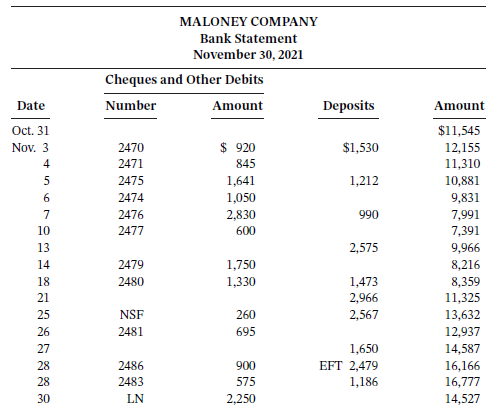

The adjusted cash balance per bank agreed with the cash balance per books at October 31. The November bank statement showed the following:

Additional information from the bank statement:

1. The EFT of $2,479 is an electronic transfer from a customer in payment of its account. The amount includes $49 of interest that Maloney Company had not previously accrued.

2. The NSF for $260 is a $245 cheque from a customer, Pendray Holdings, in payment of its account, plus a $15 processing fee. The company?s policy is to pass on all NSF service charges to the customer.

3. The LN is a payment of a note payable with the bank and consists of $250 interest and $2,000 principal.

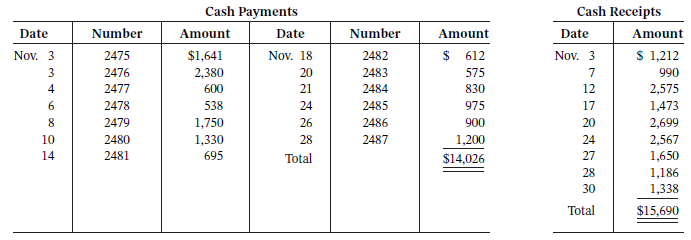

4. At October 31, the cash balance per books was $10,160. The bank did not make any errors. The cash records per books for November follow. Two errors were made by Maloney Company.

Instructions

a. Prepare a bank reconciliation at November 30.

b. Prepare the necessary adjusting entries at November 30. The correction of any errors in the recording of cheques should be made to Accounts Payable except for item 3, which should be made to Notes Payable. The correction of any errors in the recording of cash receipts should be made to Accounts?

When there is an error, how does a company determine if it was a bank error or a company error? How would you know if the bank has made an error in your account?

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak