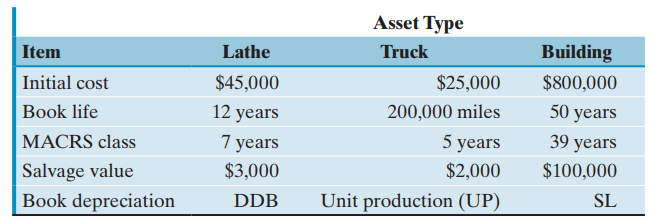

A manufacturing company has purchased three assets: The truck was depreciated by the unitsofproduction method. Usage of

Question:

The truck was depreciated by the units€of€production method. Usage of the truck was 22,000 miles and 25,000 miles during the first two years, respectively.

(a) Calculate the book depreciation for each asset for the first two years.

(b) If the lathe is to be depreciated over the early portion of its life by the DDB method and then by a switch to the SL method for the remainder of its life, when should the switch occur?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: