Randall Motor Company (Randall) owns 100% of Randall Motor Credit Corporation (RMCC), its financing subsidiary. Randall's main

Question:

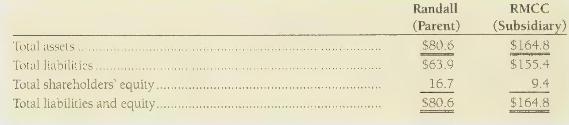

Randall Motor Company (Randall) owns 100\% of Randall Motor Credit Corporation (RMCC), its financing subsidiary. Randall's main operations consist of manufacturing automotive products. RMCC mainly helps people finance the purchase of automobiles from Randall and its dealers. The two companies' individual balance sheets are adapted and summarized as follows (amounts in billions):

Assume that RMCC's liabilities include \(\$ 1.6\) billion owed to Randall, the parent company.

{Requirements}

1. Compute the debt ratio of Randall Motor Company considered alone.

2. Determine the consolidated total assets, total liabilities, and shareholders' equity of Randall Motor Company after consolidating the financial statements of RMCC into the totals of Randall, the parent company 3. Recompute the debt ratio of the consolidated entity. Why do companies prefer not to consolidate their financing subsidiaries into their own financial statements?

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin