A city government has a nine-year capital lease for property being used within the General Fund. The

Question:

A city government has a nine-year capital lease for property being used within the General Fund.

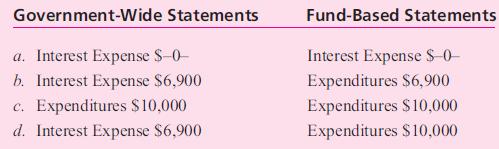

The lease was signed on January 1, 2010. Minimum lease payments total \($90,000\) starting at the end of the first year but have a current present value of \($69,000.\) Annual payments are \($10,000,\) and the interest rate being applied is 10 percent. When the first payment is made on December 31, 2010, which of the following recordings is made?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: