CarpetWorld has two departments, Carpet and Drapery. It uses a biweekly payroll system. It pays its salesclerks

Question:

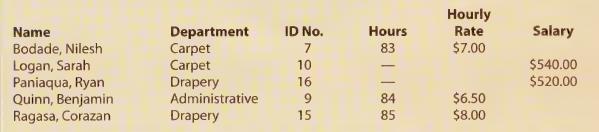

CarpetWorld has two departments, Carpet and Drapery. It uses a biweekly payroll system. It pays its salesclerks and employees in the accounting department on an hourly basis, and they receive 1/2 times the regular hourly pay rate for all hours worked in excess of 40 hours in one week. The employee hours worked and pay rates for selected employees are shown below.

A partially completed payroll register for the biweekly pay period ended March 12 of the current year is provided in the Working Papers.

Use the commissions records from Application Problem 3-1 and the partially completed payroll register provided in the Working Papers to complete the payroll register. The following additional information is also needed:

a. A deduction for federal income tax is to be made from each employee's total earnings. Use the appropriate income tax withholding tables shown in Lesson 3-1.

b. A deduction of 2% for state income tax is to be made from each employee's total earnings.

c. A deduction of 6.2% for social security and 1.45% for Medicare tax is to be made from each employee's total earnings.

d. All employees have dental insurance, \($9.40,\) and health insurance, \($13.20,\) deducted from their pay each biweekly pay period. These deductions are to be recorded in the Other Deductions column of the payroll register. Use D to indicate the dental insurance deduction. Use H to indicate the health insurance deduction.

Both of these deductions are written on one line of the payroll register for each employee.

Instructions:

Complete the payroll register for the pay period ended March 12 and paid on March 19 of the current year.

Data from Problem 3-1

CarpetWorld employs a departmental supervisor for each of its two departments, Carpet and Drapery.

Departmental supervisors receive a biweekly salary and monthly commissions of 1% of net sales. They receive their commissions for the previous month in the first pay period of the current month. The following data are from the accounting records for the month ended February 28 of the current year.

a. Carpet Department: sales on account, \($8,623.40;\) cash and credit card sales, \($12,936.20;\) sales discount, \($148.90;\) sales returns and allowances, \($1,699.30.\)

b. Drapery Department: sales on account, \($7,223.89;\) cash and credit card sales, \($13,987.11;\) sales discount, \($337.17;\) sales returns and allowances, \($654.33.\)

Step by Step Answer: