Expenses incurred in one fiscal period but not paid until a later date are called accrued expenses.

Question:

Expenses incurred in one fiscal period but not paid until a later date are called accrued expenses. During the last fiscal period of each year, Costco incurs salary and benefit expenses that are not paid until the following fiscal year.

This occurs when a fiscal year ends in the middle of a payroll period. The accounting concept Matching Revenue with Expenses requires that financial statements must show all business expenses for a fiscal period. Consequently, Costco must report the unpaid salary and benefit amount even though it has not yet paid out cash. The unpaid amount owed for incurred employee salaries and benefits represents a liability. Use the material shown in Appendix B of this text to answer the questions below.

Instructions:

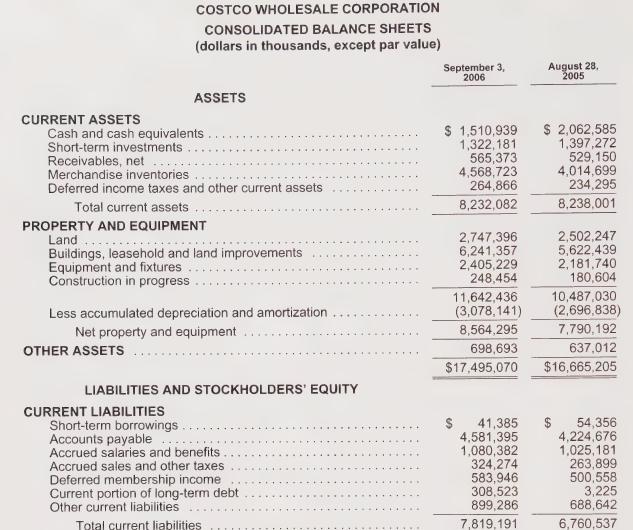

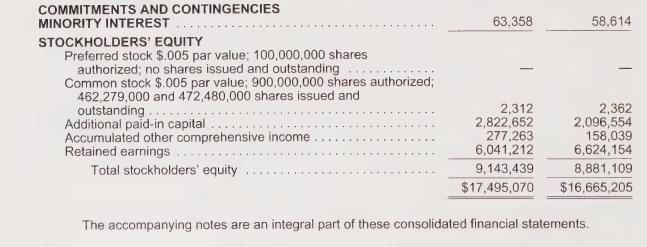

1. Referring to the consolidated balance sheets on page B-6,

(a) list the title of the account that represents an amount owed for salaries and benefits and

(b) list the amounts owed for this account on September 3, 2006, and August 28, 2005.

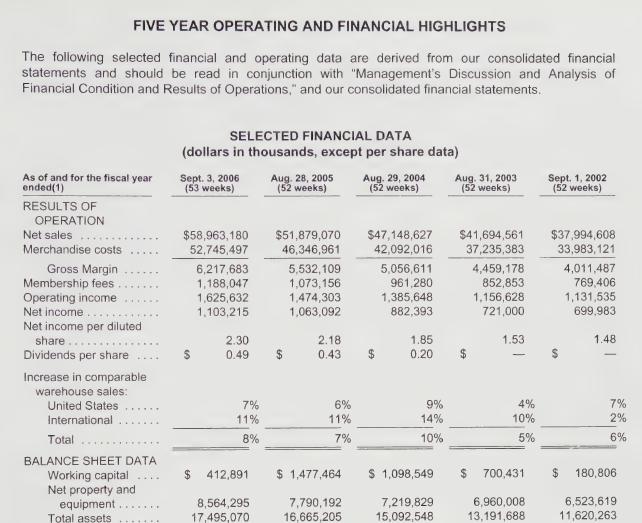

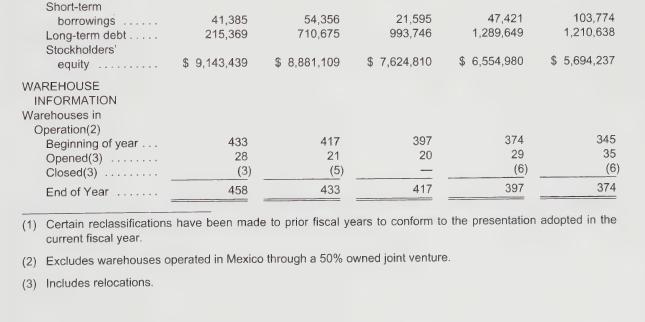

2. Referring to the five-year operating and financial highlights on page B-3, identify one fact that would help explain the increase in this liability. List at least two other reasons that might explain the increase.

Data from Appendix B-3

Data from Appendix B-6

Step by Step Answer: