Early in 2022, Bicycle Messenger Service Corporation (BMSC) purchased a multiline/multifunction telephone system at a cost of

Question:

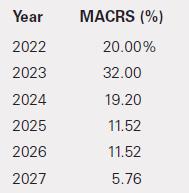

Early in 2022, Bicycle Messenger Service Corporation (BMSC) purchased a multiline/multifunction telephone system at a cost of $50,000. At that time, BMSC estimated that the system had a useful life of 5 years with no salvage value expected at the end of that time. The company elected to use the straight-line method for financial reporting with a half-year depreciation taken in the first and last years of the asset’s life. For tax purposes, the company depreciates the system using the following percentages:

There were no permanent differences during both 2022 and 2023. Income before tax and depreciation is $120,000 in 2018 and $200,000 in 2019. The company is subject to a 40% tax rate.

Required

a. Prepare a schedule comparing book and tax depreciation and show the deferred tax provision and the cumulative balance of the deferred tax account.

b. Compute income tax expense and income taxes payable for 2022 and 2023.

c. What is the balance in the deferred tax account at December 31, 2023?

d. What is the firm’s reported net income for 2022 and 2023?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella