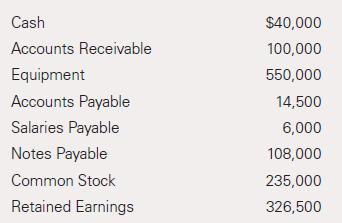

G&S Auto Body, Inc. started 2022 with the following balances: The following transactions occurred during the current

Question:

G&S Auto Body, Inc. started 2022 with the following balances:

The following transactions occurred during the current year:a. On January 1, the owners invested a total of $150,000 (the par value of the stock) as an additional capital contribution. In exchange, the corporation issued the owners 50,000 shares of common stock.

b. On March 23, the company paid cash to purchase office equipment for $108,000.

c. On April 18, the company made a payment on the note due to a bank, $10,000.

d. On May 5, the company collected the balance of accounts receivable due from the prior year.

e. On May 31, salaries were accrued for time worked in May in the amount of $2,000. These salaries will be paid in June.

f. On June 30, the company paid cash to employees for salaries accrued on May 31 as well as the balance due from the prior year.

g. On July 8, the company paid cash for accounting fees in the amount of $6,000.

h. On September 6, the company performed repair work on a fleet of vehicles at a total charge of $76,000. The customer paid cash for half of the transaction and put the other half on its credit account with G&S.

i. On November 9, the customer who engaged G&S to do the repair work on September 6 paid off its account balance with cash.

j. On December 15, the company made a $10,000 cash payment to purchase parts and supplies (record in Parts and Supplies Inventory).

Required

a. Show the effect of each transaction on assets, liabilities, and equity using the accounting equation.

b. Prepare the journal entry for each transaction. Omit explanations.

c. Post each journal entry to the t-accounts and determine the ending balances of each account at the end of the year.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella