Griffey Manufacturing's sales slumped badly in 2010. For the first time in its history, it operated at

Question:

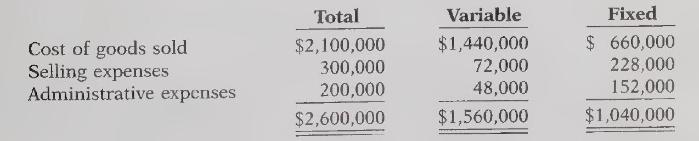

Griffey Manufacturing's sales slumped badly in 2010. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 500,000 units of product: Net sales \(\$ 2,500,000\); total costs and expenses \(\$ 2,600,000\); and net loss \(\$ 100,000\). Costs and expenses consisted of the following.

Management is considering the following independent alternatives for 2011.

1. Increase unit selling price \(20 \%\) with no change in costs and expenses.

2. Change the compensation of salespersons from fixed annual salaries totaling \(\$ 210,000\) to total salaries of \(\$ 70,000\) plus a \(4 \%\) commission on net sales.

3. Purchase new automated equipment that will change the proportion between variable and fixed cost of goods sold to \(60 \%\) variable and \(40 \%\) fixed.

Instructions:

(a) Compute the break-even point in dollars for 2010.

(b) Compute the break-even point in dollars under each of the alternative courses of action. (Round to the nearest dollar.) Which course of action do you recommend?

Step by Step Answer:

Accounting Tools For Business Decision Making

ISBN: 9780470377857

3rd Edition

Authors: Paul D. Kimmel