Patterson Products Inc. is considering an upgrade to its manufacturing equipment. The two upgrade options under consideration

Question:

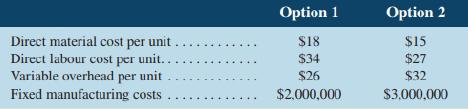

Patterson Products Inc. is considering an upgrade to its manufacturing equipment. The two upgrade options under consideration are shown below.

The selling price of the company's product is $120 per unit with variable selling costs of 5% of sales. Fixed selling and administrative costs are $3,300,000 per year. There would be no change to the selling price, variable selling costs, or fixed selling and administrative costs as the result of the manufacturing equipment upgrade.

Required

1. At what annual number of unit sales would Patterson Products Inc. be indifferent between the two upgrade options?

2. If demand falls short of the indifference point calculated in part (I), which option would be preferred?

3. Calculate the break-even point in unit sales under each upgrade option.

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby