Praton Company is considering automating its production facility. The initial investment in automation would be ($8,000,000) and

Question:

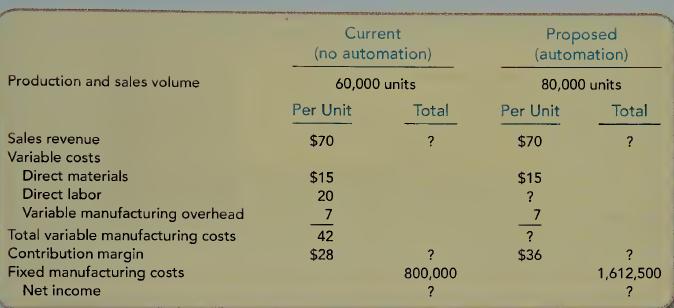

Praton Company is considering automating its production facility. The initial investment in automation would be \($8,000,000\) and the equipment has a useful life of eight years with a residual value of \($1,500,000\). The company will use straight-line depreciation. Praton could expect a production increase of 20,000 units per year and a reduction of 40 percent in the labor cost per unit.

Required:

1. Complete the preceding table showing the totals and summarize the difference in the alternatives.

2. Determine the project’s accounting rate of return.

3. Determine the project’s payback period.

4. Using a discount rate of 15 percent, calculate the net present value (NPV) of the proposed investment.

5. Recalculate the NPV using a discount rate of 10 percent.

6. Would you advise Praton to invest in the automation?

Step by Step Answer:

Managerial Accounting

ISBN: 9780078110771

1st Edition

Authors: Stacey WhitecottonRobert LibbyRobert Libby, Patricia LibbyRobert Libby, Fred Phillips