Refer to your solutions for Larrys Sporting Goods in PA5-2. Required: 1. Consider the pattern of Larrys

Question:

Refer to your solutions for Larry’s Sporting Goods in PA5-2.

Required:

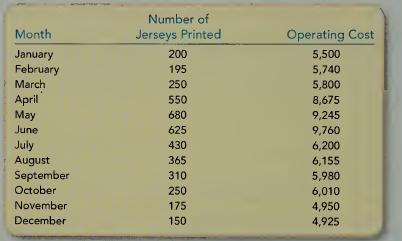

1. Consider the pattern of Larry’s activity and costs throughout the year. Would you consider this to be a seasonal business? Explain your answer and how this information could impact the relative proportion of fixed and variable costs for the store’s business.

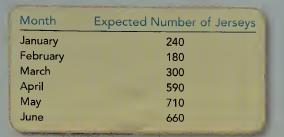

2. Using the cost estimates obtained with the high-low and regression methods, predict the store’s operating costs for the upcoming months based on expected sales levels.

3. Explain why there are differences between cost predictions based on high-low method and least-squares regression. Which do you think is more accurate? Why?

4. Using the regression results, prepare contribution margin income statements for January through June. Assume that the average sales price is \($18\) per jersey.

5. Based on the regression equation, what is Larry’s expected fixed cost per month? What would Larry expect total annual fixed cost to be?

6. Suppose that the store’s actual fixed cost last year was \($51,000.\) Explain why this amount varies from the prediction based on the regression results.

Data from PA5-2

Larry’s Sporting Goods is a locally owned store that specializes in printing team jerseys. The majority of its business comes from orders for various local teams and organizations. While Larry’s prints everything from bowling team jerseys to fraternity/sorority apparel to special event shirts, summer league baseball and softball team jerseys are the company’s biggest source of revenue.

A portion of Larry’s operating information for the company’s last year follows:

Step by Step Answer:

Managerial Accounting

ISBN: 9780078110771

1st Edition

Authors: Stacey WhitecottonRobert LibbyRobert Libby, Patricia LibbyRobert Libby, Fred Phillips