Wing Walker Aces (WWA), Inc., is considering the purchase of a small plane to use in its

Question:

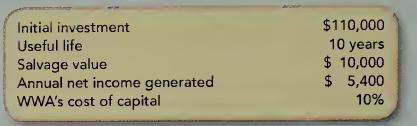

Wing Walker Aces (WWA), Inc., is considering the purchase of a small plane to use in its wing- walking demonstrations and aerial tour business. Various information about the proposed investment follows:

Required:

Help WWA evaluate this project by calculating each of the following:

1. Accounting rate of return.

2. Payback period.

3. Net present value (NPV).

4. Recalculate WWA's NPV assuming the cost of capital is 6 percent.

5. Based on your calculations of NPV, what would you estimate the project’s internal rate of return to be?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 9780078110771

1st Edition

Authors: Stacey WhitecottonRobert LibbyRobert Libby, Patricia LibbyRobert Libby, Fred Phillips

Question Posted: