On January 1, 2017, Paul Company purchased 80% of the voting stock of Simon Company for $1,360,000

Question:

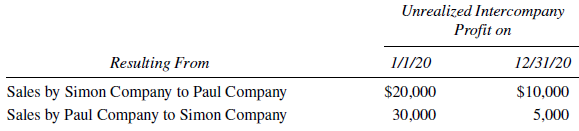

On January 1, 2017, Paul Company purchased 80% of the voting stock of Simon Company for $1,360,000 when Simon Company had retained earnings and capital stock in the amounts of $450,000 and $1,000,000, respectively. The difference between implied and book value is allocated to a franchise and is amortized over 25 years. Simon Company?s retained earnings amount to $780,000 on January 1, 2020, and $960,000 on December 31, 2020. In 2020, Simon Company reported net income of $270,000 and declared dividends of $90,000. Paul Company reported net income from independent operations in 2020 in the amount of $700,000 and retained earnings on December 31, 2020, of $1,500,000. During 2020, intercompany sales of merchandise from Paul to Simon amounted to $70,000 and from Simon to Paul were $50,000. Unrealized profits on January 1 and on December 31, 2020, resulting from intercompany sales are as summarized here:

There were no intercompany sales prior to 2019.

Required:

A. Prepare in general journal form the entries necessary in the December 31, 2020, consolidated statements workpaper to eliminate the effects of the intercompany sales.

B. Calculate controlling interest in consolidated net income for the year ended December 31, 2020.

C. Calculate consolidated retained earnings on December 31, 2020.

D. Calculate noncontrolling interest in consolidated income for the year ended December 31, 2020.

Step by Step Answer: