1. Coy Corporation and its divisions are engaged solely in manufacturing operations. The following data (consistent with...

Question:

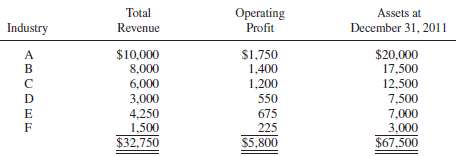

1. Coy Corporation and its divisions are engaged solely in manufacturing operations. The following data (consistent with prior years' data) pertain to the industries in which operations were conducted for the year ended December 31, 2011 (in thousands):

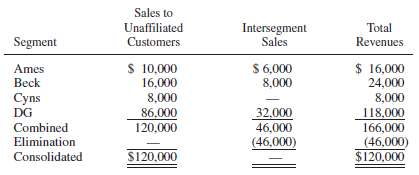

In its segment information for 2011, how many reportable segments does Coy have?(a) Three(b) Four(c) Five(d) Six2. Hen Corporation's revenues for the year ended December 31, 2011, are as follows (in thousands):Consolidated revenue per income statement .... $1,200Intersegment sales ............... 180Intersegment transfers ............... 60Combined revenues of all segments ....... $1,440Hen has a reportable segment if that segment's revenues exceed:(a) $6(b) $24(c) $120(d) $1443. The following information pertains to Ari Corporation and its divisions for the year ended December 31, 2011 (in thousands):Sales to unaffiliated customers ........... $4,000Intersegment sales of products similar to thosesold to unaffiliated customers ........... 1,200Interest earned on loans to other industry segments .... 80The intersegment interest is not reported by the divisions on internal reports reviewed by the chief operating officer. Ari and all of its divisions are engaged solely in manufacturing operations. Ari has a reportable segment if that segment's revenue exceeds:(a) $528(b) $520(c) $408(d) $4004. The following information pertains to revenue earned by Wig Company's operating segments for the year ended December 31, 2011:

In conformity with the revenue test, Wig reportable segments were:(a) Only DG(b) Beck and DG(c) Ames, Beck, and DG(d) Ames, Beck, Cyns, and DGUse the following information in answering questions 5 and 6: Gum Corporation, a publicly owned corporation, is subject to the requirements for segment reporting. In its income statement for the year ended December 31, 2011, Gum reported revenues of $50,000,000, operating expenses of $47,000,000, and net payroll costs of $15,000,000.Gum's combined identifiable assets of all industry segments at December 31, 2011, were $40,000,000.5. In its 2011 financial statements, Gum should disclose major customer data if sales to any single customer amount to at least:(a) $300,000(b) $1,500,000(c) $4,000,000(d) $5,000,0006. In its 2011 financial statements, if Gum is organized on an industry basis, it should disclose foreign operations data on a specific country if revenues from that country's operations are at least:(a) $5,000,000(b) $4,700,000(c) $4,000,000(d) $1,500,0007. Selected data for a segment of a business enterprise are to be separately reported in accordance with GAAP when the revenues of the segment exceed 10% of the:(a) Combined net income of all segments reporting profits(b) Total revenues obtained in transactions with outsiders(c) Total revenues of all the enterprise's operating segments(d) Total combined revenues for all segments reporting profits8. In financial reporting of segment data, which of the following items is used in determining a segment's operating income?(a) Income tax expense(b) Sales to other segments(c) General corporate expense(d) Gain or loss on discontinued operations

GAAPGenerally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith