1. On January 1, 2011, Pan Company sold equipment to its wholly-owned subsidiary, Sun Company, for $1,800,000....

Question:

1. On January 1, 2011, Pan Company sold equipment to its wholly-owned subsidiary, Sun Company, for $1,800,000. The equipment cost Pan $2,000,000. Accumulated depreciation at the time of sale was $500,000. Pan was depreciating the equipment on the straight-line method over 20 years with no salvage value, a procedure that Sun continued. On the consolidated balance sheet at December 31, 2011 the cost and accumulated depreciation, respectively, should be:

a. $1,500,000 and $600,000

b. $1,800,000 and $100,000

c. $1,800,000 and $500,000

d. $2,000,000 and $600,000

2. In the preparation of consolidated financial statements, intercompany items for which eliminations will not be made are:

a. Purchases and sales where the parent employs the equity method

b. Receivables and payables where the parent employs the cost method

c. Dividends received and paid where the parent employs the equity method

d. Dividends receivable and payable where the parent employs the equity method

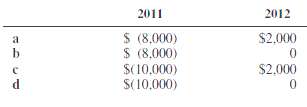

3. Pun Corporation owns 100 percent of Sir Corporation's common stock. On January 2, 2011, Pun sold to Sir for $40,000 machinery with a carrying amount of $30,000. Sir is depreciating the acquired machinery over a fiveyear life by the straight-line method. The net adjustments to compute 2011 and 2012 consolidated income before income tax would be an increase (decrease) of:

4. Pot Company owns 100 percent of Sal Company. On January 1, 2011, Pot sold Sal delivery equipment at a gain. Pot had owned the equipment for two years and used a five-year straight-line depreciation rate with no residual value. Sal is using a three-year straight-line depreciation rate with no residual value for the equipment. In the consolidated income statement, Sal's recorded depreciation expense on the equipment for 2011 will be decreased by:a. 20% of the gain on saleb. 33.33% of the gain on salec. 50% of the gain on saled. 100% of the gain onsale

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith