1. Partners Allen, Baker, and Coe share profits and losses 50:30:20, respectively. The balance sheet at April...

Question:

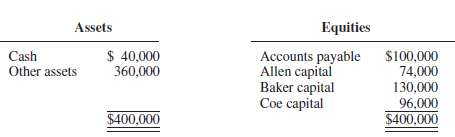

1. Partners Allen, Baker, and Coe share profits and losses 50:30:20, respectively. The balance sheet at April 30, 2011, follows:

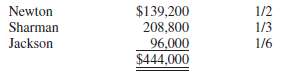

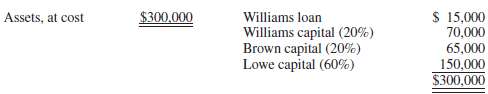

The assets and liabilities are recorded and presented at their respective fair values. Jones is to be admitted as a new partner with a 20% capital interest and a 20% share of profits and losses in exchange for a cash contribution. No goodwill or bonus is to be recorded. How much cash should Jones contribute?(a) $60,000(b) $72,000(c) $75,000(d) $80,0002. Elton and Don are partners who share profits and losses in the ratio of 7:3, respectively. On November 5, 2011, their respective capital accounts were as follows:Elton .... $ 70,000Don ..... 60,000$130,000On that date they agreed to admit Kravitz as a partner with a one-third interest in the capital and profits and losses upon his investment of $50,000. The new partnership will begin with a total capital of $180,000. Immediately after Kravitz's admission, what are the capital balances of Elton, Don, and Kravitz, respectively?(a) $60,000, $60,000, $60,000(b) $63,000, $57,000, $60,000(c) $63,333, $56,667, $60,000(d) $70,000, $60,000, $50,0003. William desires to purchase a one-fourth capital and profit and loss interest in the partnership of Eli, George, and Dick. The three partners agree to sell William one-fourth of their respective capital and profit and loss interests in exchange for a total payment of $40,000. The capital accounts and the respective percentage interests in profits and losses immediately before the sale to William are as follows:Eli capital (60%) ..... $ 80,000George capital (30%) .... 40,000Dick capital (10%) ..... 20,000$140,000All other assets and liabilities are fairly valued, and implied goodwill is to be recorded prior to the acquisition by William. Immediately after William's acquisition, what should be the capital balances of Eli, George, and Dick, respectively?(a) $60,000, $30,000, $15,000(b) $69,000, $34,500, $16,500(c) $77,000, $38,500, $19,500(d) $92,000, $46,000, $22,0004. The capital accounts of the partnership of Newton, Sharman, and Jackson on June 1, 2011, are presented, along with their respective profit and loss ratios:

On June 1, 2011, Sidney was admitted to the partnership when he purchased, for $132,000, a proportionate interest from Newton and Sharman in the net assets and profits of the partnership. As a result of this transaction, Sidney acquired a one-fifth interest in the net assets and profits of the firm. Assuming that implied goodwill is not to be recorded, what is the combined gain realized by Newton and Sharman upon the sale of a portion of their interests in the partnership to Sidney?(a) $0(b) $43,200(c) $62,400(d) $82,0005. Kern and Pate are partners with capital balances of $60,000 and $20,000, respectively. Profits and losses are divided in the ratio of 60:40. Kern and Pate decide to admit Grant, who invested land valued at $15,000 for a 20% capital interest in the partnership. Grant's capital account should be credited for:(a) $12,000(b) $15,000(c) $16,000(d) $19,0006. James Dixon, a partner in an accounting firm, decided to withdraw from the partnership. Dixon's share of the partnership profits and losses was 20%. Upon withdrawing from the partnership, he was paid $74,000 in final settlement for his partnership interest. The total of the partners' capital accounts before recognition of partnership goodwill prior to Dixon's withdrawal was $210,000. After his withdrawal, the remaining partners' capital accounts, excluding their share of goodwill, totaled $160,000. The total agreed-upon goodwill of the firm was:(a) $120,000(b) $140,000(c) $160,000(c) $250,0007. On June 30, 2011, the balance sheet for the partnership of Williams, Brown, and Lowe, together with their respective profit and loss ratios, is summarized as follows:

Williams has decided to retire from the partnership, and by mutual agreement the assets are to be adjusted to their fair value of $360,000 at June 30, 2011. It is agreed that the partnership will pay Williams $102,000 cash for his partnership interest exclusive of his loan, which is to be repaid in full. Goodwill is to be recorded in this transaction, as implied by the excess payment to Williams. After Williams's retirement, what are the capital account balances of Brown and Lowe, respectively?(a) $65,000 and $150,000(b) $97,000 and $246,000(c) $73,000 and $174,000(d) $77,000 and $186,000

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith