1. [Preferred stock] Pin Corporation owns 20% of Sob Corporation's preferred stock and 80% of its common...

Question:

1. [Preferred stock] Pin Corporation owns 20% of Sob Corporation's preferred stock and 80% of its common stock. Sob's stock outstanding on December 31, 2011, is as follows:

10% cumulative preferred stock .. $ 200,000

Common stock .......... 1,400,000

Sob reported net income of $120,000 for the year ended December 31, 2011. What amount should Pin record as equity in earnings of Sob for the year ended December 31, 2011?

(a) $84,000

(b) $96,000

(c) $96,800

(d) $100,000

2. [Tax] Pat Corporation uses the equity method to account for its 25% investment in Sam, Inc. During 2011, Pat received dividends of $30,000 from Sam and recorded $180,000 as its equity in the earnings of Sam. Additional information follows:

??? The dividends received from Sam are eligible for the 80% dividends-received deduction.

??? There are no other temporary differences.

??? Enacted income tax rates are 30% for 2011 and thereafter.

In its December 31, 2011, balance sheet, what amount should Pat report for deferred income tax liability?

(a) $9,000

(b) $10,800

(c) $45,000

(d) $54,000

3. [Tax] In 2011, Pal Corporation received $300,000 in dividends from Sal Corporation, its 80%-owned subsidiary. What net amount of dividend income should Pal include in its 2011 consolidated tax return?

(a) $300,000

(b) $240,000

(c) $210,000

(d) $0

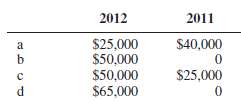

4. [Tax] Pot Corporation and Sly Corporation filed consolidated tax returns. In January 2011, Pot sold land, with a basis of $60,000 and a fair value of $75,000, to Sly for $100,000. Sly sold the land in December 2012 for $125,000. In its 2012 and 2011 tax returns, what amount of gain should be reported for these transactions in the consolidatedreturn?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith