1. Shirley purchased an interest in the Tony and Olga partnership by paying Tony $40,000 for half...

Question:

1. Shirley purchased an interest in the Tony and Olga partnership by paying Tony $40,000 for half of his capital and half of his 50 percent profit sharing interest. At the time, Tony's capital balance was $30,000 and Olga's capital balance was $70,000. Shirley should receive a credit to her capital account of:

(a) $15,000

(b) $20,000

(c) $25,000

(d) $33,333

2. Lin and Que are partners with capital balances of $50,000 and $70,000, respectively, and they share profits and losses equally. The partners agree to take Dun into the partnership for a 40% interest in capital and profits, while Lin and Que each retain a 30% interest. Dun pays $60,000 cash directly to Lin and Que for his 40% interest, and goodwill implied by Dun's payment is recognized on the partnership books. If Lin and Que transfer equal amounts of capital to Dun, the capital balances after Dun's admittance will be:

(a) Lin, $35,000; Que, $55,000; Dun, $60,000

(b) Lin, $45,000; Que, $45,000; Dun, $60,000

(c) Lin, $36,000; Que, $36,000; Dun, $48,000

(d) Lin, $26,000; Que, $46,000; Dun, $48,000

Use the following information in answering questions 3 and 4: McC and New are partners with capital balances of $70,000 and $50,000, respectively, and they share profit and losses equally. Oak is admitted to the partnership with a contribution to the partnership of $50,000 cash for a one-third interest in the partnership capital and in future profits and losses.

3. If the goodwill is recognized in accounting for the admission of Oak, what amount of goodwill will be recorded?

(a) $60,000

(b) $20,000

(c) $10,000

(d) $6,667

4. If no goodwill is recognized, the capital balances of McC and New immediately after the admission of Oak will be:

(a) McC, $65,000; New, $45,000

(b) McC, $66,667; New, $46,666

(c) McC, $67,500; New, $47,500

(d) McC, $70,000; New, $50,000

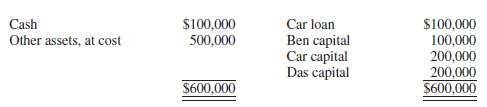

5. The December 31, 2011, balance sheet of the Ben, Car, and Das partnership is summarized as follows:

The partners share profits and losses as follows: Ben, 20 percent; Car 30 percent; and Das, 50 percent. Car is retiring from the partnership, and the partners have agreed that "other assets" should be adjusted to their fair value of $600,000 at December 31, 2011. They further agree that Car will receive $244,000 cash for his partnership interest exclusive of his loan, which is to be paid in full, and that no goodwill implied by Car's payment will be recorded.

After Car's retirement, the capital balances of Ben and Das, respectively, will be:

(a) $116,000 and $240,000

(b) $101,714 and $254,286

(c) $100,000 and $200,000

(d) $73,143 and$182,857

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith