A business entity's taxable income before the cost of certain fringe benefits paid to owners and other

Question:

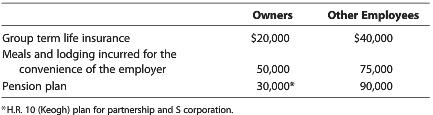

A business entity's taxable income before the cost of certain fringe benefits paid to owners and other employees is $400,000. The amounts paid for these fringe benefits are as follows:

The business entity is equally owned by four owners.

a. Calculate the taxable income of the business entity if the entity is a partnership, a C corporation, and an S corporation.

b. Determine the effect on the owners for each of the three business forms.

Transcribed Image Text:

Owners Other Employees $40,000 75,000 Group term life insurance Meals and lodging incurred for the $20,000 convenience of the employer Pension plan *H.R. 10 Keogh) plan for partnership and S corporation. 50,000 30,000 90,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

a Assuming that the fringe benefit plans are not discriminatory the potential exists for the employer business entity to deduct the amounts paid for f...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business Law questions

-

A business entity has four equal owners. Its taxable income before the cost of certain fringe benefits paid to owners and other employees is $400,000. The amounts paid for these fringe benefits are...

-

In 2016, Tish acquires and places into service in her business 7-year MACRS property costing $40,000 and 5-year MACRS property costing $165,000. Tish elects Sec. 179 expensing for all of the...

-

In July 2014, Tish acquires and places in service a business machine costing $40,000 with a 7-year MACRS recovery period. Tish elects the maximum allowable Sec. 179 expense on the machine. In August...

-

(a) Find the Maclaurin series for the function f(x)= ln(1+x) and hence that for In(1+x) (b) By keeping the first four terms in the Maclaurin series for In(1+x) integrate the function In(1+x) from x =...

-

What is the opportunity cost of having excessive amounts of liquid funds?

-

Why is the alternate form of Newtons second law of motion given in this chapter the more general form?

-

Draw an energy diagram for the cart in Figure 9.2 \(b\). Figure 9.2 The work done on a system is positive if the system gains kinetic energy and negative if the system loses kinetic energy. (a) Cart...

-

Kathy Gannon is the new owner of Kathys Computer Services. At the end of July 2014, her first month of ownership, Kathy is trying to prepare monthly financial statements. She has the following...

-

19. Consider the given arrangement. The two slits S and S are illuminated by monochromatic light of wavelength A. Slits S3 and S4 are at separation d minimum intensity on the screen will be 2.D =...

-

For this question you will adapt the lab notebook for decision trees. Your task is to build a decision tree with just 3 predictor variables, income, house value and whether college attended or not....

-

Mr. and Mrs. Coleman are going to establish a manufacturing business. They anticipate that the business will be profitable immediately due to a patent Mrs. Coleman holds. They predict that profits...

-

Turtle, a C corporation, has taxable income of $300,000 before paying salaries to the three equal shareholder-employees, Britney, Shania, and Alan. Turtle follows a policy of distributing all...

-

Suggest a reason for the observation that people with sickle-cell trait sometimes have breathing problems during high-altitude flights.

-

Please answer the following question: The State ofAirmaniais a developed country with very high environmental standards applicable to domestic industries. Consumers inAirmaniahave a strong demandfor...

-

You work at a hospital and you have been asked to give a presentation to the medical staff summarizing the key points of a pending bill in your state that would change the requirements for newborn...

-

A proton moves through a magnetic field at 33.7% of the speed of light. At one location, the field has a magnitude of 0.00609 T and the proton's velocity makes an angle of 143 with the field. Use c =...

-

Identify factors that drive change within an organization, community, and individual 2. Identify barriers to change 3. Apply change management models and concepts to demonstrate an understanding of...

-

What is the difference between given a friend some advice and opinion versus engaging in the authorized practice of law?

-

Worf Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of equipment were recorded in random order during the calendar year...

-

The 2017 financial statements of the U.S. government are available at: https://www.fiscal.treasury.gov/fsreports/rpt/finrep/fr/fr_index.htm Use these to answer the following questions: a. Statement...

-

As long as each click on an ad link on the Web triggers a commission that has to be paid, we will be facing a financial formula that gives rise to unethical behavior. Do you think that technology...

-

If one of Vokess fellow students, rather than her instructor, had praised her ability and encouraged her to buy more lessons, should the result in this case have been different? Explain.

-

Could the court have severed the unconscionable portions of the arbitration clause and otherwise allowed arbitration to proceed? Why or why not?

-

A home-based sign company uses this function to model its monthly profit, where x is the price of each sign it sells. p(x)=-10x^(2)+498x-1,500 What is the company's profit if it sells each sign for...

-

Based on your analysis of the market data and a comprehensive understanding of the customer and buying processes, write a 2-3 page description of the major segments of the market and the specific...

-

Suppose that a rectangular lot has a width of x+2 and a length of 4(x-1). Write the perimeter P as a function of x.

Study smarter with the SolutionInn App