Alpha has owned 75% of the equity shares of Beta since the incorporation of Beta. Therefore, Alpha

Question:

Notes to the financial statements

Note 1 €“ Inter-company sales

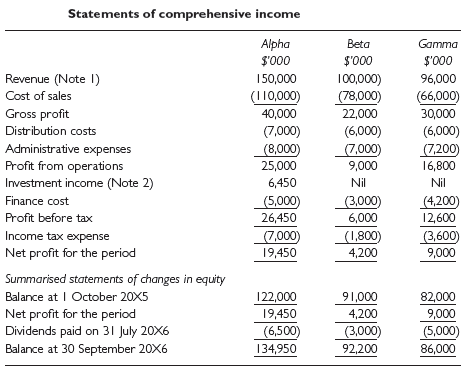

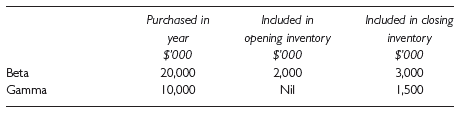

Alpha sells products to Beta and Gamma, making a profit of 25% on the cost of the products sold. All the sales to Gamma took place in the post-acquisition period. Details of the purchases of the products by Beta and Gamma, together with the amounts included in opening and closing inventories in respect of the products, are given below:

There were no other inter-company sales between Alpha, Beta or Gamma during the period.

Note 2 €“ Investment income

Alpha€™s investment income includes dividends received from Beta and Gamma and interest receivable from Beta. The dividend received from Gamma has been credited to the statement of comprehensive income of Alpha without time apportionment. The interest receivable is in respect of a loan of $20 million to Beta at a fixed rate of interest of 6% per annum. The loan has been outstanding for the whole of the year ended 30 September 20X6.

Note 3 €“ Details of acquisitions by Alpha

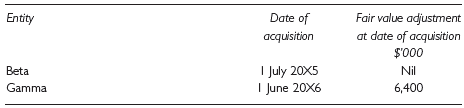

There has been no impairment of the goodwill arising on the acquisition of Beta or of the investment in Gamma since the dates of acquisition of either entity.

The fair value adjustment has the effect of increasing the fair value of property, plant and equipment above the carrying value in the individual financial statements of Gamma. Group policy is to depreciate property, plant and equipment on a monthly basis over its estimated useful economic life.

The estimated life of the property, plant and equipment of Gamma that was subject to the fair value adjustment is five years, with depreciation charged against cost of sales.

Note 4 €“ other information

— The purchase of shares in Gamma entitled Alpha to appoint a representative to the board of directors of Gamma. This meant that Alpha was potentially able to participate in, and significantly influence, the policy decisions of Gamma.

— No other investor is able to control the operating and financial policies of Gamma, but on one occasion since 1 July 20X6 Gamma made a policy decision with which Alpha did not fully agree.

— Alpha has not entered into a contractual relationship with any other investor to exercise joint control over the operating and financial policies of Gamma.

— All equity shares in Beta carry one vote at general meetings.

— The policy of Alpha regarding the treatment of equity investments in its consolidated financial statements is as follows:

€“ Subsidiaries are fully consolidated.

€“ Joint ventures are proportionally consolidated.

€“ Associates are equity accounted.

€“ Other investments are treated as available for sale financial assets.

Your assistant has been reading the working papers for the consolidated financial statements of Alpha for previous years. He has noticed that Beta has been consolidated as a subsidiary and has expressed the view that this must be because Alpha owns more than 50% of its shares. He has further stated that Gamma should be treated as an available-for-sale financial asset since Alpha is unable to control its operating and financial policies.

Required:

(a) Prepare the consolidated statement of comprehensive income and consolidated statement of changes in equity of Alpha for the year ended 30 September 20X6. Notes to the consolidated statement of comprehensive income are not required. Ignore deferred tax.

(b) Assess the observations of your assistant regarding the appropriate method of consolidating Beta and Gamma. Your assessment need NOT include an explanation of the detailed mechanics of consolidation. You should refer to the provisions of international financial reporting standards where you consider they will assist yourexplanation.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott