Alternative allocation bases for a professional services firm. The Wolfson Group (WO) provides tax advice to multinational

Question:

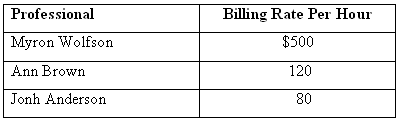

Alternative allocation bases for a professional services firm. The Wolfson Group (WO) provides tax advice to multinational firms. WG charges clients for (a) direct professional time (at an hourly rate) and (b) support services (at 30% of the direct professional costs billed). The three professionals in W6 and their rates per professional hour are:

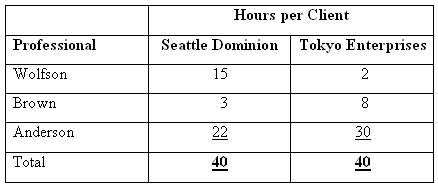

WG has just prepared the May 2009 bills for two clients. The hours of professional time spent on each client are as follows:

1. What amounts did WG bill to Seattle Dominion and Tokyo Enterprises for May 2009?

2. Suppose support services were billed at $50 per professional labor-hour (instead of 30% of professional labor costs). How would this change affect the amounts WG billed to the two clients for May 2009? Comment on the differences between the amounts billed in requirements 1 and 2.

3. How would you determine whether professional labor costs or professional labor-hours is the more appropriate allocation base for WG’s support services?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav