Analyzing the Effects of Four Alternative Inventory Methods Dixon Company uses a periodic inventory system. At the

Question:

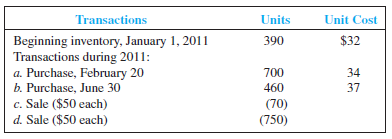

Analyzing the Effects of Four Alternative Inventory Methods Dixon Company uses a periodic inventory system. At the end of the annual accounting period, December 31, 2011, the accounting records for the most popular item in inventory showed the following:

Required:

Compute the cost of

(a) Goods available for sale,

(b) Ending inventory, and

(c) Goods sold at December 31, 2011, under each of the following inventory costing methods (show computations and round to the nearest dollar):

1. Average cost (round average cost per unit to the nearest cent).

2. First-in, first-out.

3. Last-in, first-out.

4. Specific identification, assuming that the first sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of February 20, 2011. Assume that the second sale was selected from the remainder of the beginning inventory, with the balance from the purchase of June 30, 2011.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer: