Boom, Inc., sells business software. Currently, all of its programs come on disks. Due to their complexity,

Question:

Boom, Inc., sells business software. Currently, all of its programs come on disks. Due to their complexity, some of these applications occupy as many as seven disks. Not only are the disks cumbersome for customers to load, they are relatively expensive for Boom to purchase. The company does not intend to discontinue using disks altogether. However, it does want to reduce its reliance on the disk medium.

Two proposals are being considered. The first is to provide software on memory sticks. Doing so requires a $500,000 investment in duplicating equipment. The second is to make software available through a computerized “program bank.†In essence, programs would be downloaded directly from Boom using telecommunications technology. Customers would gain access to Boom’s main-frame, specify the program they wish to order, and provide their name, address, and credit card information. The software would then be transferred directly to the customer’s hard drive, and copies of the user’s manual and registration material would be mailed the same day. The program bank proposal requires an initial investment of $350,000.

The following information pertains to these proposals. Due to rapidly changing technology, neither proposal is expected to have any salvage value or an estimated life exceeding five years.

-1.png)

The only difference between Boom’s incremental cash flows and its incremental income is attributable to depreciation. A minimum return on investment of 12 percent is required.

Instructions

a. Compute the payback period of each proposal.

b. Compute the return on average investment of each proposal.

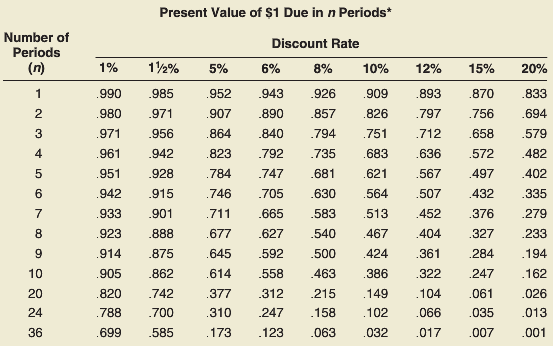

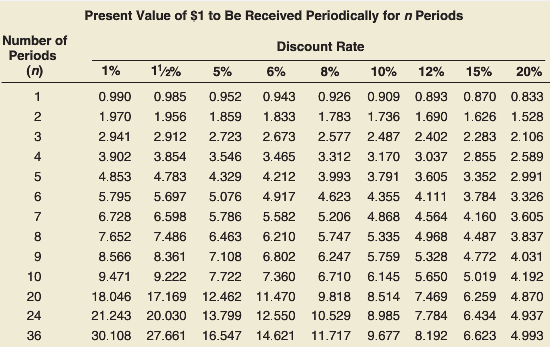

c. Compute the net present value of each proposal using the tables in Exhibits 26–3 and 26–4.

d. What nonfinancial factors should be considered?

e. Which of Boom’s employees would most likely underestimate the benefits of investing in the program bank? Why?

f. Which proposal, if either, do you recommend Boom choose?

In Exhibits 26–3

In Exhibits 26–4

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078111044

16th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello