Business Taxes: In this exercise, suppose that your hamburger business McWendys has a homothetic decreasing returns to

Question:

A: Suppose that your restaurant, by operating at its long run profit maximizing production plan („“ˆ—,kˆ—, xˆ—), is currently making zero long run profit. In each of the policy proposals in parts (b) through (h) below, suppose that prices w, r and p remain unchanged.5 In each part, beginning with (b), indicate what happens to your optimal production plan in the short and long run.

(a) Illustrate the short run AC and MC curves as well as the long run AC curve. Where in your graph can you locate your short run profit €” and what is it composed of?

(b) Suppose the government determined that profits in your industry were unusually high last year €” and imposes a one-time €œwindfall profits tax€ of 50% on your business€™s profits from last year.

(c) The government imposes a 50% tax on short run profits from now on.

(d) The government instead imposes a 50% tax on long run profits from now on.

(e) The government instead taxes franchise fees causing the blood sucking McWendy€™s parent company to raise its fee to G > F.

(f) The government instead imposes a tax t on capital (which is fixed in the short run) used by your restaurant €” causing you to have to pay not only r but also tr to use one unit of capital.

(g) Instead of taxing capital, the government taxes labor in the same way as it taxed capital in part (f).

(h) Finally, instead of any of the above, the government imposes a €œhealth tax€ t on hamburgers €” charging you $t for every hamburger you sell.

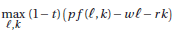

B: In previous exercises, we gave the input demand functions for a firm facing prices (w,r, p) and technology f („“,k) = A„“αkβ (with α,β > 0 and α+β < 1) in equation (13.50) and the long run output supply function in equation (13.49) €” both given in footnotes to earlier end-of-chapter exercises in this chapter.

(a) When you add a recurring fixed cost F, how are these functions affected? (You will have to restrict the set of prices for which the functions are valid €” and you can use the profit function given in exercise 13.7) to do this strictly in terms of A, α, β and the prices (w,r,p).) What are the short run labor demand and output supply functions for a given k̅?

(b) For each of (b) through (h) in part A of the exercise, indicate whether (and how) the functions you derived in part (a) are affected.

(d) This affects none of the functions. You can again see that the long run functions are unaffected by realizing that a tax on long run profits drops out as we solve the profit maximization problem

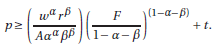

Where t stands for the tax rate applied to long run profit. Put differently, since the government taking a fraction of long run profit does not cause long run profit to become negative, this tax will never cause the inequality in equations (13.118), (13.119) and (13.120) to not hold.

(e) Since F does not appear in the short run equations, the new fixed cost G will also not appear €” leaving the short run curves unaffected. F does, however, appear in equations (13.118), (13.119) and (13.120) €” or, to be more precise, it appears in the inequality that restricts the prices for which the functions are applicable. As F increases, the inequality will no longer hold for some range of prices at the lower end €” thus raising the price at which the firm exits. If, for instance, the firm was initially making zero long run profit, it would exit with an increase in F to G because the inequality in (13.118), (13.119) and (13.120) no longer holds.

(f) Since r appears in equations (13.118), (13.119) and (13.120), we know that the long run functions are affected. They are affected in two ways: First, the equations themselves are affected, with an increase in r causing a decrease in „“, k, and x; and second, the inequality is affected in the sense that the inequality now no longer holds for some range of prices at the lower end. This implies that, in the long run, the firm will reduce its output and its demand for labor and capital €” and it will reduce these to zero if the inequality no longer holds. For instance, if long run profit is initially zero, the firm will exit (unless something else changes). In the short run, however, r does not appear in either the labor demand or output supply equations €” and thus nothing changes in the short run.

(g) The impact on the long run will mirror what we just described in (f) for a capital tax. In the short run, however, there was no impact of the tax on capital because r did not enter the short run labor demand or output supply functions €” but w does appear in these, which implies that the labor tax has an immediate short run impact. In particular, an increase in w causes an immediate decrease in both labor demand and output supply.

(h) The tax on hamburgers will also have short and long run impacts on our derived functions by changing the output price from p to (p ˆ’ t ). This lower output price will shift short run supply and short run labor demand in the respective short run functions, reducing the quantity in each. In the long run, p appears in both the initial equation as well as the in- equality of expressions (13.118), (13.119) and (13.120). In the equations to the left of each expression, p changes to (p ˆ’ t) €” causing a drop in each. In the inequalities on the right, p changes to (p ˆ’ t) on the left-hand side of the inequality, or €” alternatively, we can rewrite the inequality as

This implies that the price for which the input demand and output supply functions are valid increases €” again €œshortening€ the input demand and output demand curves. If, for instance, the firm was making zero profit before the implementation of the tax, it will exit after the implementation (unless something else changes).

Step by Step Answer:

Microeconomics An Intuitive Approach with Calculus

ISBN: 978-0538453257

1st edition

Authors: Thomas Nechyba