Carl owns 100% of the common shares of Extra Ltd., a Canadian-controlled private corporation operating a wholesale

Question:

Carl owns 100% of the common shares of Extra Ltd., a Canadian-controlled private corporation operating a wholesale business in eastern Canada. Extra’s fiscal year end is May 31, 20X8. It is now April 15, 20X8, and Carl has just signed a letter of intent to sell the wholesale business to Q Ltd.

The initial discussions involved the sale of specific assets of Extra, but a sale of the shares of the company may also be considered. Carl has requested your assistance in estimating the tax liability to Extra if the business assets are sold. Information relating to the sale and to the current year’s operating income is provided below.

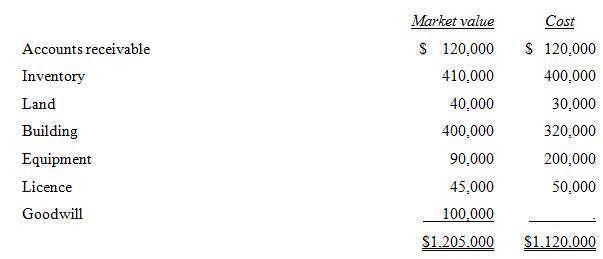

1. The balance sheet of Extra at May 31, 20X8, is estimated as follows:

Accounts receivable ………………………….. | $ 120,000 |

Inventory, at cost ………………………….. | 400,000 |

Land, at cost ………………………….. | 30,000 |

Building, at book value ………………………….. | 280,000 |

Equipment, at book value ………………………….. | 170,000 |

Licence, at book value ………………………….. | 40,000 |

| $1,040,000 |

Liabilities ………………………….. | $ 500,000 |

Share capital ………………………….. | 1,000 |

Retained earnings ………………………….. | 539,000 |

…………………………..………………………….. | $1,040,000 |

2. Net income before income tax and net gains from the sale of assets for the year ended May 31, 20X8, is estimated as follows:

Income from wholesale operations ………………………….. | $490,000 |

Dividend income ………………………….. | 1,000 |

Net income before tax ………………………….. | $491,000 |

The following additional information relates to the net income:

• The dividend income is from a Canadian public corporation, the shares of which were sold during the year for proceeds equal to their original cost.

• Expenses deducted from revenues included the following items:

Legal fees for collection of bad debts……… | $ 2,000 |

Donations to registered charities……………… | 3,000 |

Meals and beverages to entertain customers ……………… | 4,000 |

Dividend paid to Carl on March 31, 20X8 ……………… | 20,000 |

Replacing a broken window in the building ……………… | 2,400 |

3. The 20X7 income tax return indicates the following tax account balances:

RDTOH ……………… | NIL |

Capital dividend account ……………… | NIL |

Cumulative eligible capital ……………… | NIL |

GRIP……………… | NIL |

Undepreciated capital cost | |

Class 1 ……………… | 290,000 |

Class 8 ……………… | 140,000 |

Class 14 ……………… | 42,000 |

4. The letter of intent regarding the sale of the business indicates that the closing date will be May 31, 20X8.The letter included the following list of assets to be sold, together with each asset’s estimated market value. For information, the original cost of each asset is provided.

Payment for the above assets would consist of cash plus the assumption of Extra’s liabilities.

5. You have suggested to Carl that he consider selling the common shares of Extra, rather than the specific assets. You have estimated the market value of the shares to be $600,000.The shares were acquired in 20X1 for a cost of $100,000. In previous years, Carl had used the capital gains deduction to exempt $120,000 of gains from tax. His cumulative net investment loss (CNIL) at the end of 20X8 is estimated to be $40,000.

Required:

1. Under Part I of the Income Tax Act, determine the minimum income for tax purposes and the minimum taxable income for Extra for the 20X8 taxation year, assuming that all assets are sold.

2. Based on your answer to Requirement 1, calculate the minimum Part I and Part IV federal income tax for the 20X8 taxation year. Your answer should include a calculation of the RDTOH and dividend refund, if any.

3. If an agreement is made to sell the assets of Extra, would you recommend the planned closing date of May 31, 20X8, or a delay of one day to June 1, 20X8? Explain.

4. Briefly outline what the purchaser should consider when choosing between the purchase of assets and the purchase of shares.

5. If Carl decides to sell the shares of Extra, what amount will be added to his net income for tax purposes in his 20X8 taxation year?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold