Company manufactures a single product that requires a great deal of hand labor. Overhead cost is applied

Question:

Company manufactures a single product that requires a great deal of hand labor. Overhead cost is applied on the basis of standard direct labor-hours. Variable manufacturing overhead should be $2 per standard direct labor-hour and fixed manufacturing overhead should be $480,000 per year. The company’s product requires 3 pounds of material that has a standard cost of $7 per pound and 1.5 hours of direct labor time that has a standard rate of $12 per hour.

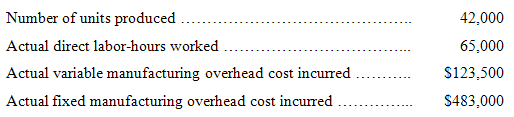

The company planned to operate at a denominator activity level of 60,000 direct labor-hours and to produce 40,000 units of product during the most recent year. Actual activity and costs for the year were as follows:

Required:

1. Compute the predetermined overhead rate for the year. Break the rate down into variable and fixed elements.

2. Prepare a standard cost card for the company’s product; show the details for all manufacturing costs on your standard cost card.

3. Do the following:

(a) Compute the standard direct labor-hours allowed for the year’s production.

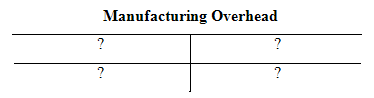

(b) Complete the following Manufacturing Overhead T-account for the year:

4. Determine the reason for any underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances.

5. Suppose the company had chosen 65,000 direct labor-hours as the denominator activity rather than 60,000 hours. State which, if any, of the variances computed in (4) above would have changed, and explain how the variance(s) would have changed. No computations are necessary.

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer