Compute the undervaluation penalty for each of the following independent cases involving the value of a closely

Question:

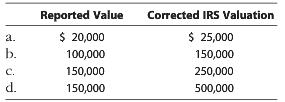

Compute the undervaluation penalty for each of the following independent cases involving the value of a closely held business in the decedent's gross estate. In each case, assume a marginal estate tax rate of 40%.

Transcribed Image Text:

Reported Value $20,000 100,000 150,000 150,000 Corrected IRS Valuation at. ь. с. d. $25,000 150,000 250,000 500,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

a 0 Additional tax 2000 is less than 5000 b 0 Valuation cla...View the full answer

Answered By

Fahmin Arakkal

Tutoring and Contributing expert question and answers to teachers and students.

Primarily oversees the Heat and Mass Transfer contents presented on websites and blogs.

Responsible for Creating, Editing, Updating all contents related Chemical Engineering in

latex language

4.40+

8+ Reviews

22+ Question Solved

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business Law questions

-

For each of the following independent cases (A through E), compute the missing values in the table: Total Prime Cost Conversion Cost Direct Materials Labor Direct ManufacturingManufacturing Case...

-

For each of the following independent cases A through D, compute the missing values: Cost of Goods Manufactured BegInning Finished Goods Inventory Ending Finished Goods Inventory Cost of Goods Sold...

-

For each of the following independent cases of employee fraud, recommend how to prevent similar problems in the future. a. Abnormal inventory shrinkage in the audiovisual department at a retail chain...

-

Consider n x n real matrices A satisfying A = A = A-. (a) When n = 2, determine all such matrices. (b) Assuming that -1 is not an eigenvalue of A, determine all such nxn matrices.

-

Sandy and Phil have recently married and are both in their early 20s. In establishing their financial goals, they determine that their three long-term goals are to purchase a home, to provide their...

-

Fill in the blanks with an appropriate word, phrase, or symbol(s). A rigid motion that moves a geometric figure by sliding it along a straight line segment in the plane is called a(n) ___________.

-

A wire bent into a semicircle of radius \(R\) lies in a plane that is perpendicular to a uniform external magnetic field \(\vec{B}\). If the wire carries a current \(I\), what are the magnitude and...

-

Bonadio Electrical Supplies distributes electrical components to the construction industry. The company began as a local supplier 15 years ago and has grown rapidly to become a major competitor in...

-

In the space provided, 150- to 350-word summary of your financial analysis from Part 2: Financial Ratio Calculations. Include the following in your summary: Make final recommendations as to whether...

-

Tim O'Hare is the distribution manager for Consolidated, Inc. Major builders can order from Consolidated, Inc. two products: door hardware and casters. Since the construction industry goes through...

-

Recently, a politician was interviewed about fiscal policy, and she mentioned reducing the "tax gap." Explain what this term means. What are some of the pertinent political and economic issues...

-

Singh, a qualified appraiser of fine art and other collectibles, was advising Colleen when she was determining the amount of the charitable contribution deduction for a gift of sculpture to a museum....

-

Selected information relating to Yost Company's operations for the most recent year is given below: Activity: Denominator activity (machine-hours) . . . . . . . 45,000 Standard hours allowed per unit...

-

The budgeted variable-MOH rate at Concord Corp. is $5.40/machine hour, where every unit requires 2 machine hours. Additionally, the following fixed-MOH costs are anticipated for production:...

-

One of the top manufacturers of consumer goods in the world, Unilever, is examining its portfolio of businesses in an effort to solve the issues with unsatisfactory growth and profitability. Your...

-

On January 01, 2021 Patterson incorporated issued 5 million dollar bonds with a face value of 5% the market rate for these bonds are 10% interest is paid once a year on December 31st and the bonds...

-

Allie is 17 years old and qualifies as a dependent of her parents. Allie earned $3,400 in wages and $200 in interest income during 2023. What is Allie's basic standard deduction for 2023?

-

Discuss the implications of new rules for business combinations on financial reporting and ethical considerations. Share your thoughts on how these rules influence transparency and investor trust in...

-

The life span of a particular brand of food processor is measured by a random variable X with probability density function where x denotes the life span (in months) of a randomly selected processor....

-

In Exercises 1558, find each product. (9 - 5x) 2

-

Discuss what constitutes a passive activity.

-

Discuss what constitutes a passive activity.

-

What is the significance of the term material participation? Why is the extent of a taxpayer's participation in an activity important in determining whether a loss from the activity is deductible or...

-

Baird Company manufactures a personal computer designed for use in schools and markets it under its wn label. Baird has the capacity to produce 37,000 units a year but is currently producing and...

-

The Walton Toy Company manufactures a line of dolls and a sewing kit. Demand for the company's products is increasing, and management requests assistance from you in determining an economical sales...

-

The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are...

Study smarter with the SolutionInn App