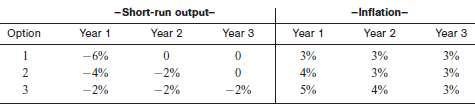

Consider an economy that begins with output at its potential level and a relatively high inflation rate

Question:

(a) According to these numbers, what is the slope of the Phillips curve?

(b) If you as a policymaker cared primarily about output and not much about the inflation rate, which option would you recommend? Why?

(c) If you cared primarily about inflation and not much about output, which option would you recommend? Why?

(d) Explain the general trade-off that policymakers are faced with according to the Phillips curve.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: