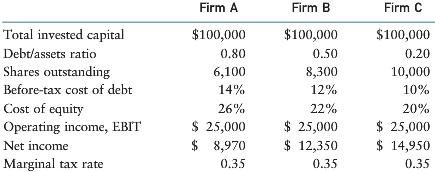

Consider the following operating information gathered from three firms that are identical except for their capital structures:

Question:

Consider the following operating information gathered from three firms that are identical except for their capital structures:

a. Compute the WACC for each firm.

b. Compute the EVA for each firm.

c. Based on the results of your computations in part (b), which firm would be considered the best investment? Why?

d. Assume the industry P/E ratio generally is 15. Using the industry norm, estimate the price for each stock.

e. What factors might cause you to adjust the P/E ratio value used in part (d) so that it is more appropriate?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: