Cost-Volume-Profit Analysis and Return on Investment (ROl) posters.com is a small Internet retailer of high-quality posters. The

Question:

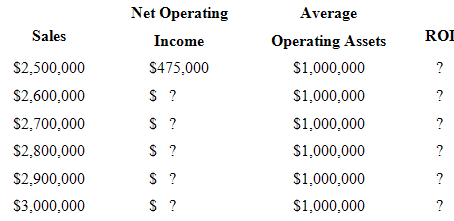

Cost-Volume-Profit Analysis and Return on Investment (ROl) posters.com is a small Internet retailer of high-quality posters. The company has $1,000,000 in operating assets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $3,000,000 per year. The company’s contribution margin ratio is 25%, which means that an additional dollar of sales results in additional contribution margin, and net operating income, of 25 cents.

Required:

1. Complete the following table showing the relation between sales and return on investment (ROl).

2. What happens to the company’s return on investment (ROl) as sales increase? Explain.

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer