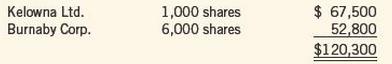

Cudmore Ltd. had two FVTPL investments at the end of 20X4, disclosed on the SFP as follows:

Question:

Cudmore Ltd. had two FVTPL investments at the end of 20X4, disclosed on the SFP as follows:

By the end of 20X4, unrealized losses of $ 4,500 related to the Kelowna Ltd. shares and unre-alized gains of $ 9,600 related to the Burnaby Corp. shares had been included in earnings. During 20X5, Cudmore sold the Kelowna Ltd. shares after receiving a dividend of $ 2 per share. Cudmore received $ 54,000 for the shares, less an $ 800 commission. Cudmore also received a dividend of $ 1 per share on the Burnaby Corp. shares, and then sold 2,000 shares for $ 9.60 per share, less a $ 500 commission. Cudmore bought 500 Wilton Ltd. shares for $ 18,000 plus a $ 500 commission. This is an FVTPL investment.

At the end of the year, the fair value of the Kelowna Ltd. shares was $ 51,000, Burnaby Corp. shares were $ 11.20 per share, and Wilton Ltd. shares had a total fair value of $ 16,000.

Required:

1. List the items that would be included in 20X5 earnings with respect to the investments.

2. List the items that would appear on the 20X5 statement of financial position with respect to the investments.

3. What criteria would have to be met to show these investments as current assets? Longterm assets?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0071339476

Volume 1, 6th Edition

Authors: Beechy Thomas, Conrod Joan, Farrell Elizabeth, McLeod Dick I