Customer profitability and ethics. Blat Corporation manufactures a product called the glat, which it sells to merchandising

Question:

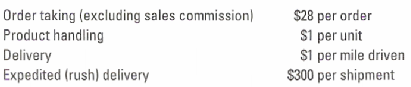

Customer profitability and ethics. Blat Corporation manufactures a product called the glat, which it sells to merchandising firms such as International House of Glats (lHoG,) Blats-R-Us (GRU,) Glat Marcus (GM,) Blat City (GC,) Good Glats (GG,) and Blat-mart (Gmart.( The list price of a glat is $40, and the full manufacturing costs are $30. Salespeople receive a commission on sales but the commission is based on number of orders taken, not on sales revenue generated or number of units sold. Salespeople receive a commission of $20 per order (in addition to regular salary.) Glat Corporation makes products based on anticipated demand. Blat Corporation carries an inventory of glats so rush orders do not result in any extra manufacturing costs over and above the $30 per glat. Blat Corporation ships finished product to the customer at no additional charge to the customer for either regular or expedited delivery. Blat incurs significantly higher costs for expedited deliveries than for regular deliveries. Expected and actual customer-level cost driver rates are:

Because salespeople are paid $20 per order, they break up large orders into multiple smaller orders. This practice reduces the actual order taking cost by $16 per smaller order (from $28 per order to $12 per order) because the smaller orders are all written at the same time. This lower cost rate is not included in budgeted rates because salespeople create smaller orders without telling management or the accounting department Also, salespeople offer customers discounts to entice them to place more orders; GRU and Gmart each receive a 5% discount off the list price of $40.

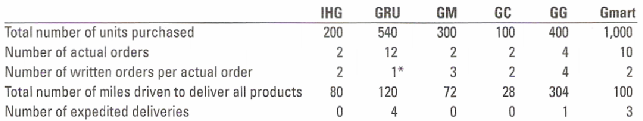

Information about Glat’s clients follows:

*Because GRU places 12 separate orders, its order costs are $28 per order. All other orders are multiple smaller orders and so have actual order costs of $12 each.

1. Using the information above, calculate the expected customer-level operating income for the six customers of Blat Corporation. Use the number of written orders at $28 each to calculate expected order costs.

2. Recalculate the customer-level operating income using the number of written orders but at their actual $12 cost per order instead of $28 (except for GRU, whose actual cost is $28 per order.) How will Blat Corporation evaluate customer-level operating cost performance this period?

3. Recalculate the customer-level operating income if salespeople had not broken up actual orders into multiple smaller orders. Don’t forget to also adjust sales commissions.

4. How is the behavior of the salespeople affecting the profit of Blat Corporation? Is their behavior ethical? What could Blat Corporation do to change the behavior of the salespeople?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav